Business inventory tax wv – Delving into the realm of business inventory tax in West Virginia, this guide offers a comprehensive exploration of its intricacies. We will delve into the definition, calculation, and significance of this tax, while also providing specific details about West Virginia’s business inventory tax, including its rate, exemptions, and filing requirements.

Furthermore, we will shed light on the various inventory valuation methods, their advantages and disadvantages, and provide guidance on selecting the most appropriate method for your business. Additionally, we will delve into best practices for inventory management, exploring techniques for minimizing costs and optimizing inventory levels.

Business Inventory Tax Overview

Business inventory tax is a tax levied on the value of a business’s inventory. It is typically assessed annually and is based on the average value of inventory held during the year. The purpose of business inventory tax is to generate revenue for local governments and to ensure that businesses are paying their fair share of taxes.

How is Business Inventory Tax Calculated?

The method for calculating business inventory tax varies from state to state. However, the most common method is to multiply the average value of inventory by the local tax rate. The average value of inventory is typically calculated by taking the sum of the beginning and ending inventory values and dividing by two.

Importance of Business Inventory Tax

Business inventory tax is an important source of revenue for local governments. It is also a way to ensure that businesses are paying their fair share of taxes. By taxing businesses on their inventory, local governments can generate revenue to fund essential services such as schools, roads, and parks.

West Virginia Business Inventory Tax

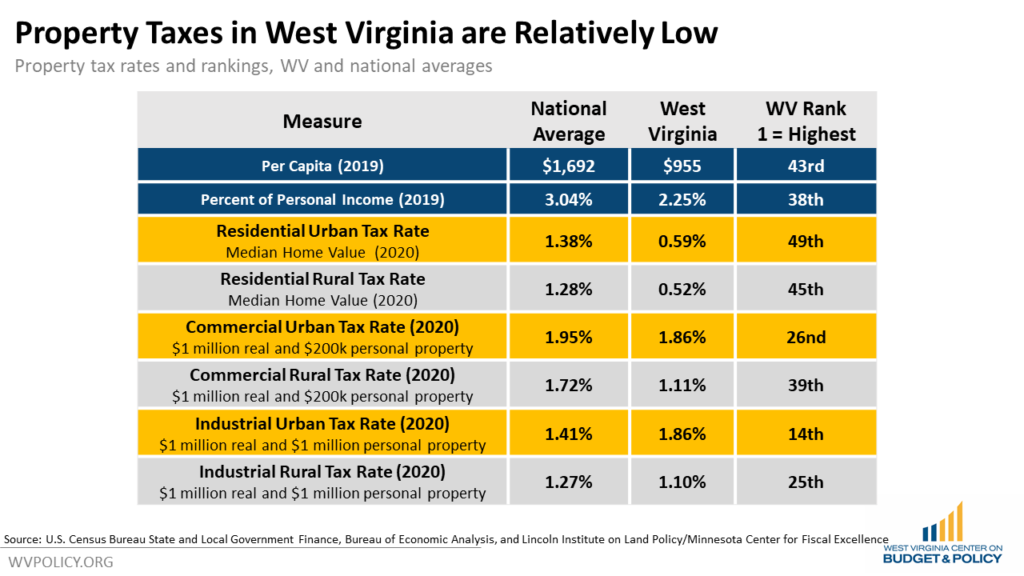

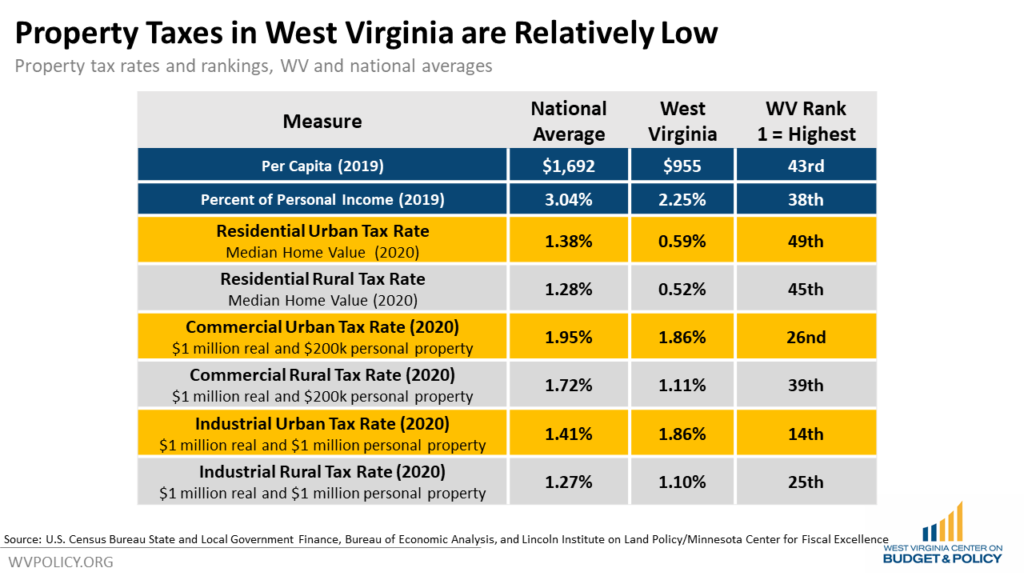

West Virginia imposes a business inventory tax on the average value of inventory held during the tax year. The tax rate is 0.55%.

Exemptions, Business inventory tax wv

The following types of inventory are exempt from the tax:

- Inventory held for sale in the ordinary course of business

- Inventory held for use in manufacturing or processing

- Inventory held by a public utility

- Inventory held by a non-profit organization

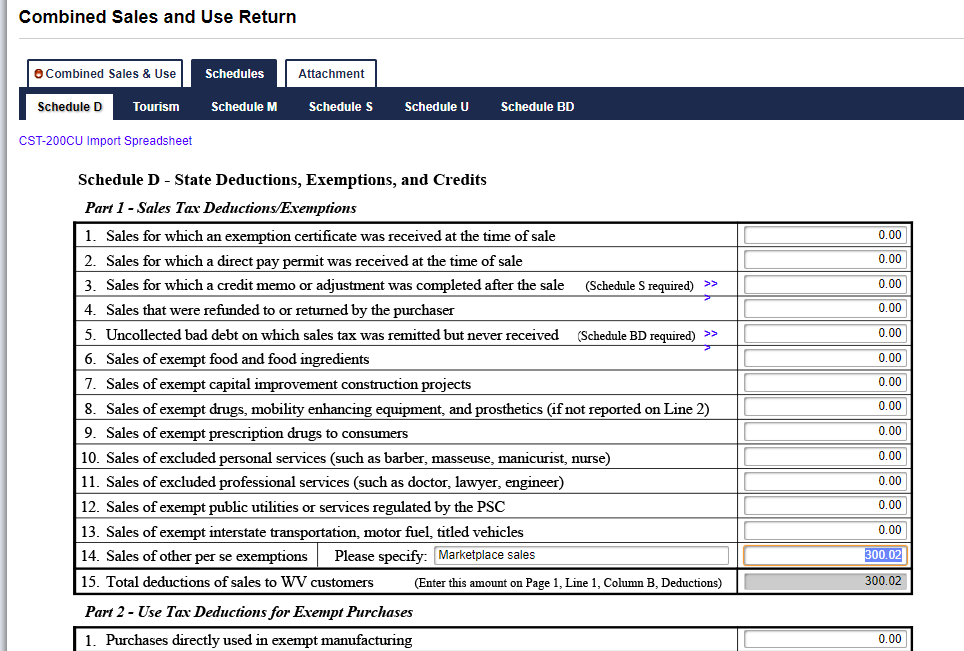

Filing Requirements

Businesses subject to the business inventory tax must file an annual return with the West Virginia Tax Department. The return is due on or before April 15th.

Final Wrap-Up: Business Inventory Tax Wv

In conclusion, this guide has provided a thorough overview of business inventory tax in West Virginia, encompassing its definition, calculation, purpose, and specific details related to the state. We have also explored inventory valuation methods and best practices for inventory management.

Understanding these aspects is crucial for businesses operating in West Virginia, as it enables them to make informed decisions regarding inventory management and tax compliance.