Navigating the intricacies of Texas business inventory tax can be a daunting task. This comprehensive guide delves into the heart of this tax, providing a clear understanding of its purpose, regulations, and impact on businesses. Dive into the realm of business inventory tax rate Texas and gain valuable insights to optimize your tax strategy.

The business inventory tax in Texas is a significant aspect of the state’s tax system, impacting various types of businesses. Understanding the tax rate, filing procedures, and economic implications is crucial for businesses to ensure compliance and minimize tax liability.

Business Inventory Tax Overview

Business inventory tax is a levy imposed on businesses in Texas for holding certain types of personal property. This tax is designed to generate revenue for the state and local governments and ensure that businesses contribute their fair share to the tax base.

Legal Framework and Regulations

The legal framework for business inventory tax in Texas is established by Chapter 11 of the Texas Tax Code. This chapter Artikels the types of property subject to the tax, the tax rates, and the exemptions and deductions available to businesses.

The Texas Comptroller of Public Accounts is responsible for administering the business inventory tax. The Comptroller’s office provides guidance to businesses on how to comply with the tax laws and regulations.

Filing and Payment Procedures

To comply with Texas business inventory tax obligations, businesses must adhere to specific filing and payment procedures. Understanding these requirements is crucial for avoiding penalties and ensuring timely tax remittance.

Texas requires businesses to file an annual business inventory tax return, Form 1120, by May 15th. The return must report the value of taxable inventory held in Texas as of January 1st of the tax year. Payments for the tax due must accompany the return.

Filing Methods

Businesses can file their business inventory tax return electronically or by mail. Electronic filing is the preferred method as it is more efficient and secure. To file electronically, businesses must register with the Texas Comptroller’s Office and obtain a taxpayer identification number.

Businesses that choose to file by mail should send their return and payment to the following address:

Texas Comptroller of Public Accounts P.O. Box 13528 Austin, TX 78711-3528

Payment Options

Businesses can make payments for their business inventory tax using various methods, including electronic funds transfer (EFT), credit card, or check. EFT is the recommended payment method as it is the most secure and efficient.

To make an EFT payment, businesses must enroll in the Comptroller’s Office’s EFT program. Once enrolled, businesses can make payments directly from their bank account.

Penalties for Late or Incorrect Filings, Business inventory tax rate texas

Filing late or incorrect business inventory tax returns can result in penalties. The penalty for late filing is 5% of the tax due, with an additional 5% penalty added for each month the return is late, up to a maximum of 25%.

The penalty for filing an incorrect return is 10% of the additional tax due.

To avoid penalties, businesses should ensure that their returns are filed on time and that the information reported is accurate and complete.

Impact on Businesses

The business inventory tax in Texas has a significant impact on various types of businesses operating within the state. The tax affects business operations, profitability, and competitiveness, necessitating strategic planning to minimize its burden.

Businesses with large inventories, such as retailers, manufacturers, and distributors, are disproportionately affected by the tax. The tax increases their cost of goods sold, reducing their profit margins and potentially making them less competitive in the market.

Impact on Business Operations

- Increased administrative costs associated with tracking and reporting inventory levels

- Potential disruption of inventory management systems

- Reduced efficiency in inventory turnover

Impact on Profitability

- Reduced profit margins due to increased cost of goods sold

- Potential for lost sales if businesses pass on the tax burden to customers

- Difficulty in competing with businesses in states without a business inventory tax

Strategies to Minimize Tax Burden

- Implementing efficient inventory management systems to reduce inventory levels

- Negotiating with suppliers to reduce inventory costs

- Exploring tax exemptions and deductions available under the Texas tax code

- Considering relocating to a state with a more favorable tax climate

Economic Considerations

Texas’s business inventory tax has significant economic implications for businesses and the state’s economy as a whole.

The tax can impact job creation, investment, and economic growth. Additionally, Texas’s business inventory tax rate differs from other states, which can influence business relocation decisions.

Job Creation and Investment

The business inventory tax can discourage businesses from investing in Texas. Businesses may choose to locate in states with lower inventory tax rates, resulting in reduced job creation and investment in Texas.

Economic Growth

The tax can also hinder economic growth by reducing business profits and limiting capital available for investment and expansion. This can lead to a slowdown in the state’s economic growth.

Comparison to Other States

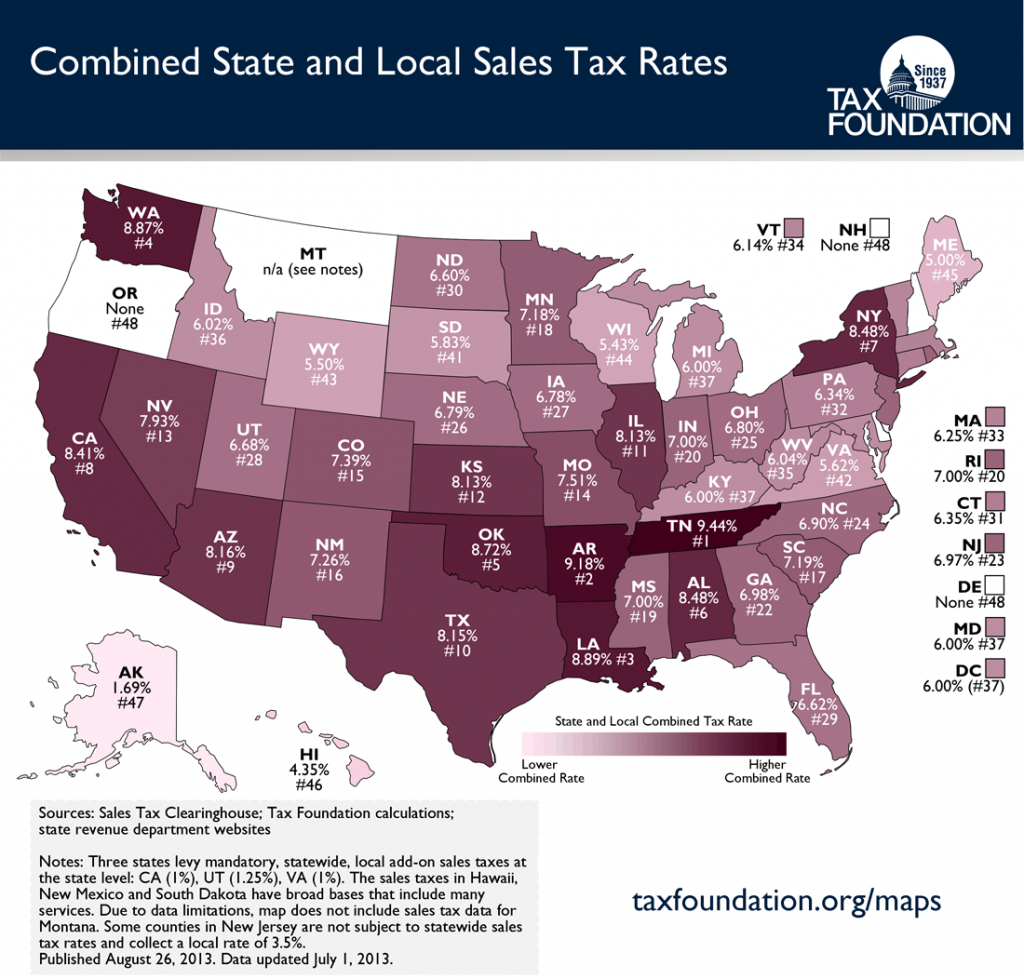

Texas’s business inventory tax rate of 0.575% is higher than the average rate of 0.45% in other states. This difference can make Texas a less attractive location for businesses, potentially leading to relocation to states with lower tax rates.

Industry-Specific Considerations

The business inventory tax in Texas can have a significant impact on certain industries that maintain large amounts of inventory. These industries face unique challenges and opportunities in managing their inventory tax liability.

Industries particularly affected by the business inventory tax include manufacturing, retail, and wholesale distribution. These industries typically have high levels of inventory on hand, which can result in substantial tax liability.

Manufacturing

- Manufacturers must consider the value of their raw materials, work-in-progress, and finished goods when calculating their inventory tax liability.

- Fluctuations in commodity prices can significantly impact the value of inventory, leading to unexpected tax liability.

- Manufacturers can use inventory management techniques, such as just-in-time inventory, to reduce their inventory tax liability.

Retail

- Retailers must consider the value of their merchandise inventory, which can vary significantly depending on seasonality and consumer demand.

- Retailers can use inventory management techniques, such as markdowns and sales, to reduce their inventory tax liability.

- Retailers can also consider using consignment inventory arrangements to reduce their inventory tax liability.

Wholesale Distribution

- Wholesale distributors must consider the value of their inventory, which can include a wide variety of products.

- Wholesale distributors can use inventory management techniques, such as bulk purchasing and inventory pooling, to reduce their inventory tax liability.

- Wholesale distributors can also consider using third-party logistics providers to reduce their inventory tax liability.

Historical Context and Trends

The business inventory tax in Texas has a long and evolving history, with significant changes and reforms shaping its current form. Understanding these historical trends provides insights into the tax’s impact on businesses and the potential implications for the future.

Initially implemented in 1931, the business inventory tax was a major source of revenue for the state. However, over the years, the tax has undergone several reforms aimed at simplifying compliance, reducing the burden on businesses, and promoting economic growth.

Tax Rate Changes

One of the most notable trends in the business inventory tax in Texas has been the gradual reduction in tax rates. In 1931, the tax rate was set at 0.5%, but it has been steadily declining since then. In 2006, the tax rate was reduced to 0.25%, and in 2019, it was further reduced to 0.125%.

This reduction in tax rates has significantly benefited businesses, reducing their tax liability and improving their cash flow.

Exemptions and Deductions

Another trend in the business inventory tax in Texas has been the expansion of exemptions and deductions. Over the years, the state has implemented various exemptions and deductions to reduce the tax burden on certain types of businesses and inventory items.

For example, businesses with less than $100,000 in inventory are exempt from the tax. Additionally, there are deductions for inventory that is used for manufacturing or processing, as well as inventory that is stored in a public warehouse.

Filing Procedures

The filing procedures for the business inventory tax in Texas have also evolved over time. Initially, businesses were required to file a return and pay the tax by April 15th. However, in 2006, the filing deadline was extended to May 15th.

Additionally, businesses can now file their returns electronically, which has streamlined the filing process and reduced compliance costs.

Potential Future Implications

The trends in tax rates, exemptions, and filing procedures suggest that the business inventory tax in Texas will continue to evolve in the future. It is likely that the tax rate will continue to decline, while exemptions and deductions will continue to expand.

Additionally, the filing process may become even more streamlined, with the potential for real-time filing and payment systems.

These trends have significant implications for businesses. Reduced tax rates will result in lower tax liabilities and improved cash flow. Expanded exemptions and deductions will reduce the tax burden on certain types of businesses and inventory items. Streamlined filing procedures will reduce compliance costs and make it easier for businesses to meet their tax obligations.

Conclusion: Business Inventory Tax Rate Texas

The business inventory tax rate in Texas has a multifaceted impact on businesses, the economy, and industry-specific sectors. By comprehending the intricacies of this tax, businesses can navigate the complexities, optimize their tax strategies, and contribute to the economic growth of Texas.