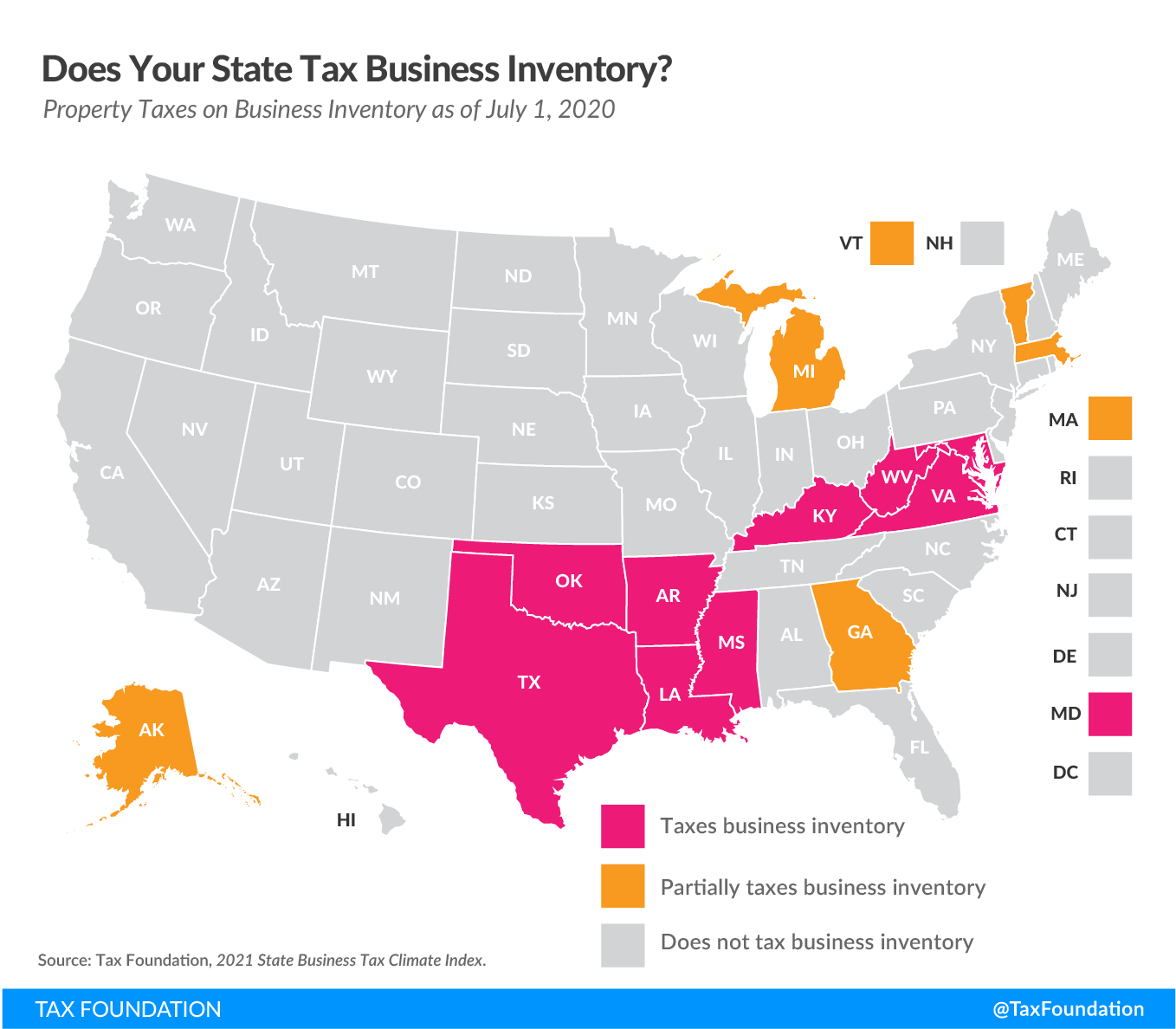

Business inventory tax deduction is a powerful tool that can help businesses reduce their tax liability. Understanding the eligibility requirements, calculation methods, and tax reporting rules is crucial for businesses to maximize this deduction. This comprehensive guide will delve into the intricacies of business inventory tax deduction, empowering businesses with the knowledge to optimize their tax strategies.

The following sections will explore the basics of business inventory tax deduction, methods for calculating the deduction, tax reporting requirements, special considerations, and tax planning strategies to help businesses make informed decisions and enhance their tax savings.

Business Inventory Tax Deduction Basics

The business inventory tax deduction allows businesses to reduce their taxable income by deducting the cost of unsold inventory at the end of the tax year. This deduction is available to businesses that use the accrual method of accounting and maintain an inventory of goods for sale.

To be eligible for the business inventory tax deduction, the inventory must be:

- Held for sale to customers in the ordinary course of business

- Purchased or produced by the taxpayer

- Not held primarily for sale to customers in the ordinary course of business

Eligible inventory items include:

- Finished goods

- Work in progress

- Raw materials

Ineligible inventory items include:

- Personal use items

- Property held for investment

- Securities

Calculating the Deduction

The inventory deduction is calculated using the cost of the inventory on hand at the end of the tax year. There are three methods that can be used to calculate the cost of inventory: LIFO, FIFO, and weighted average cost.

The choice of which method to use depends on a number of factors, including the nature of the business, the type of inventory, and the tax implications.

Last-In, First-Out (LIFO)

The LIFO method assumes that the most recently purchased inventory is the first to be sold. This means that the cost of the inventory on hand at the end of the year will be the cost of the most recent purchases.

The LIFO method can be beneficial for businesses that are experiencing inflation, as it will result in a lower cost of goods sold and a higher net income.

Example:

A company purchases 100 units of inventory at a cost of $10 per unit. The company sells 50 units during the year. Under the LIFO method, the cost of the inventory on hand at the end of the year will be $500 (50 units x $10 per unit).

First-In, First-Out (FIFO), Business inventory tax deduction

The FIFO method assumes that the oldest inventory is the first to be sold. This means that the cost of the inventory on hand at the end of the year will be the cost of the oldest purchases.

The FIFO method can be beneficial for businesses that are experiencing deflation, as it will result in a higher cost of goods sold and a lower net income.

Example:

A company purchases 100 units of inventory at a cost of $10 per unit. The company sells 50 units during the year. Under the FIFO method, the cost of the inventory on hand at the end of the year will be $600 (50 units x $12 per unit).

Weighted Average Cost

The weighted average cost method assumes that all units of inventory are purchased at the same cost. This means that the cost of the inventory on hand at the end of the year will be the average cost of all purchases made during the year.

The weighted average cost method can be beneficial for businesses that have a relatively stable inventory level.

Example:

A company purchases 100 units of inventory at a cost of $10 per unit. The company purchases another 100 units of inventory at a cost of $12 per unit. The company sells 50 units during the year. Under the weighted average cost method, the cost of the inventory on hand at the end of the year will be $550 (50 units x $11 per unit).

Tax Reporting

Reporting the inventory deduction on tax returns involves specific forms and schedules. Accurate inventory records are crucial for tax purposes, as overstating or understating inventory can lead to penalties and other consequences.

Forms and Schedules

- Form 1040 (Individual Tax Return):Schedule C, Form 1040, is used to report business income and expenses, including the inventory deduction.

- Form 1120 (Corporate Tax Return):Schedule L, Form 1120, is used to report the inventory deduction for corporations.

- Form 1065 (Partnership Tax Return):Schedule K-1, Form 1065, is used to report the inventory deduction for partnerships.

Importance of Accurate Inventory Records

Accurate inventory records are essential for tax purposes because they provide the basis for determining the cost of goods sold (COGS). COGS is a major expense that reduces taxable income. Overstating inventory can lead to an understatement of COGS and an overstatement of taxable income, resulting in higher tax liability.

Consequences of Overstating or Understating Inventory

- Overstating Inventory:Can lead to an understatement of COGS and an overstatement of taxable income, resulting in higher tax liability. Additionally, it can lead to penalties for filing an incorrect tax return.

- Understating Inventory:Can lead to an overstatement of COGS and an understatement of taxable income, resulting in lower tax liability. However, it can also lead to an understatement of assets, which can affect other financial statements and decisions.

Special Considerations

The IRS provides specific rules for inventory held by manufacturers and retailers. Additionally, obsolescence, damage, and business sale or liquidation can impact the deduction.

Manufacturers and Retailers

- Manufacturers can deduct the cost of raw materials, direct labor, and overhead allocated to unsold inventory.

- Retailers can deduct the cost of goods purchased for resale, including freight-in and other acquisition costs.

Obsolescence and Damage

Obsolescence occurs when inventory becomes outdated or unmarketable due to technological advancements or changes in consumer preferences. Damaged inventory is unsaleable due to physical defects.

Businesses can deduct the cost of obsolete or damaged inventory if they can prove its value has declined permanently.

Business Sale or Liquidation

Upon sale or liquidation of a business, the inventory’s fair market value is recognized as income. Any excess of the fair market value over the adjusted basis is subject to capital gains tax.

Last Word: Business Inventory Tax Deduction

In conclusion, business inventory tax deduction is a valuable tool for businesses to reduce their tax liability. By understanding the eligibility requirements, calculation methods, tax reporting rules, special considerations, and tax planning strategies, businesses can effectively maximize their deductions and improve their overall financial performance.

Regular review of inventory management practices and consultation with tax professionals can ensure that businesses are compliant with tax regulations and optimizing their tax savings.