Business inventory strategy abbr crossword – Unveiling the secrets behind the enigmatic abbreviation for business inventory strategy, this guide delves into the world of crossword puzzles, where knowledge and strategy intertwine to reveal the hidden meaning.

Business inventory strategy plays a pivotal role in optimizing operations, reducing costs, and maximizing profitability. Effective inventory management ensures that businesses have the right products, in the right quantities, at the right time, ultimately leading to enhanced customer satisfaction and increased revenue.

Business Inventory Strategy

A business inventory strategy refers to the set of policies and procedures a company establishes to manage its inventory levels. It involves determining the optimal amount of inventory to hold, as well as the best methods for acquiring, storing, and distributing inventory items.

An effective inventory strategy is crucial for businesses as it helps them:

- Avoid stockouts and lost sales

- Reduce carrying costs associated with holding excess inventory

- Improve customer satisfaction by ensuring timely delivery of orders

li>Optimize cash flow by reducing the amount of capital tied up in inventory

Types of Inventory Strategies, Business inventory strategy abbr crossword

There are various types of inventory strategies that businesses can adopt, each with its own advantages and disadvantages. Some of the most common strategies include:

- Just-in-time (JIT) inventory:This strategy involves holding minimal inventory levels and replenishing stock only when needed. It helps reduce carrying costs but requires a reliable supply chain and accurate demand forecasting.

- Economic order quantity (EOQ) inventory:This strategy determines the optimal quantity of inventory to order at a time to minimize total inventory costs, including ordering and carrying costs.

- Safety stock inventory:This strategy involves holding additional inventory beyond the expected demand to buffer against unexpected fluctuations in demand or supply.

- Consignment inventory:This strategy involves holding inventory that is owned by a supplier but stored at the customer’s location. The customer pays for the inventory only when it is sold.

The choice of inventory strategy depends on a variety of factors, including the nature of the business, the industry, and the specific products being sold.

Inventory Management

Inventory management is the process of overseeing and controlling the inventory of a business. This includes tracking the quantity of inventory on hand, the location of inventory, and the condition of inventory. Inventory management is important for businesses because it helps to ensure that they have the right amount of inventory on hand to meet customer demand, while also minimizing the cost of holding inventory.There are a number of different methods of inventory management, including:

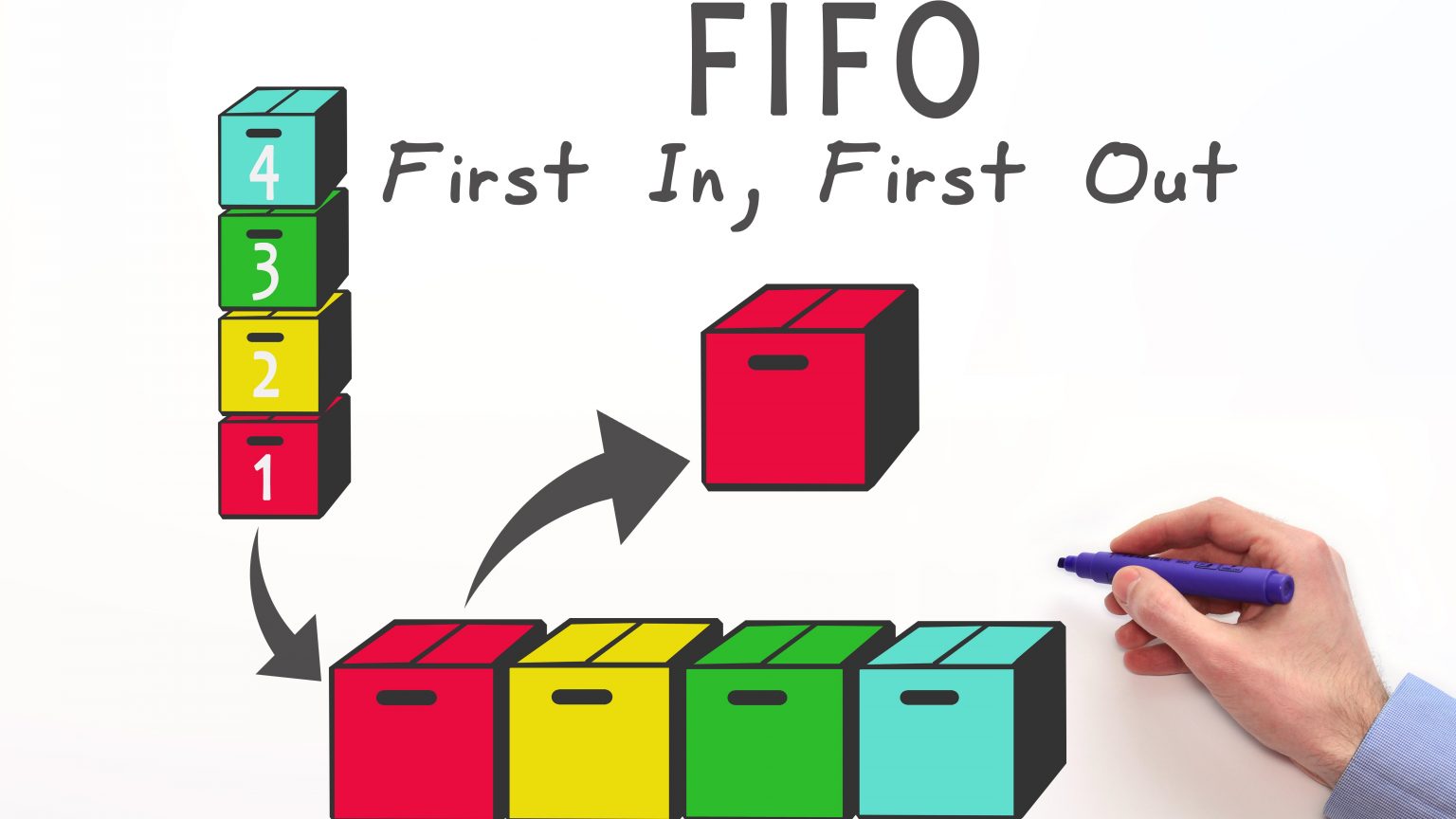

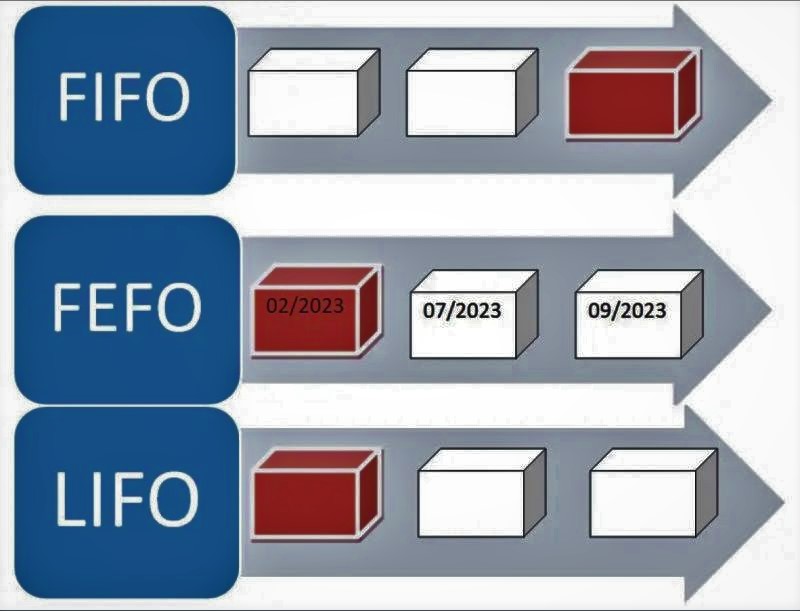

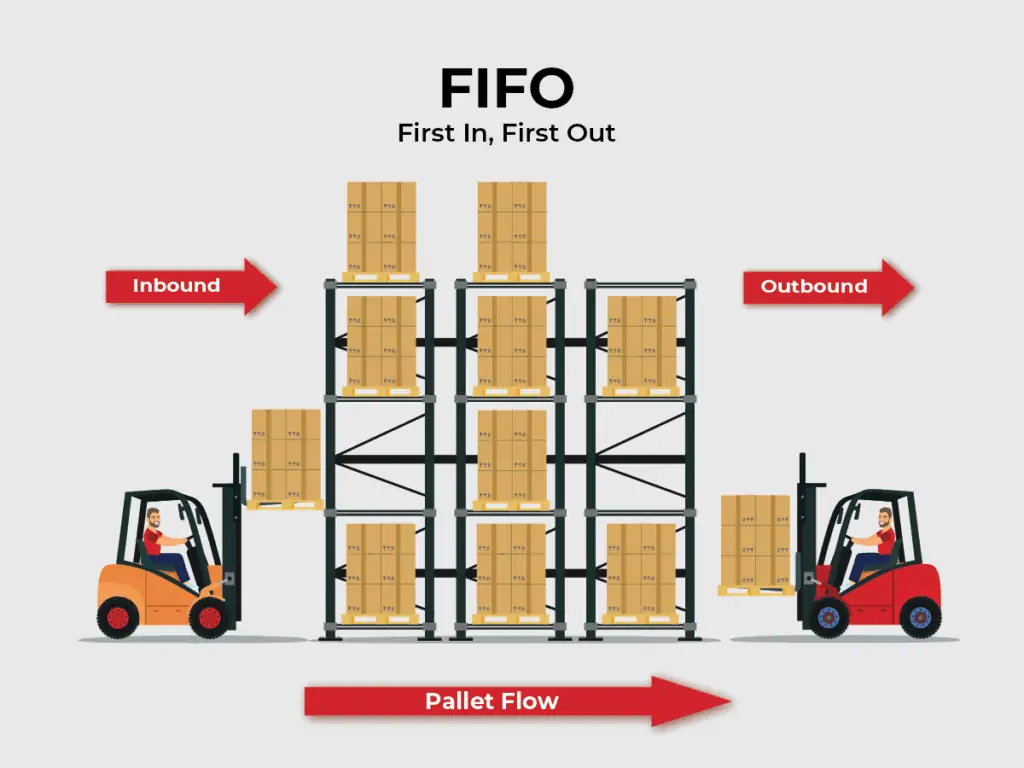

- First-in, first-out (FIFO): This method assumes that the oldest inventory is sold first. This method is often used for perishable goods, such as food and beverages.

- Last-in, first-out (LIFO): This method assumes that the newest inventory is sold first. This method is often used for non-perishable goods, such as clothing and electronics.

- Weighted average cost: This method calculates the average cost of inventory on hand, based on the cost of the most recent purchases. This method is often used for inventory that is not easily identifiable, such as bulk materials.

Challenges of Inventory Management

There are a number of challenges associated with inventory management, including:

- Inaccurate inventory data:Inaccurate inventory data can lead to a number of problems, such as overstocking or understocking of inventory, which can result in lost sales or increased costs.

- Inefficient inventory management processes:Inefficient inventory management processes can lead to delays in getting inventory to customers, which can result in lost sales or increased costs.

- Lack of visibility into inventory levels:Lack of visibility into inventory levels can make it difficult to make informed decisions about inventory management, which can result in overstocking or understocking of inventory.

Inventory Analytics

Inventory analytics is the process of collecting, analyzing, and interpreting data about inventory levels, trends, and patterns. This information can be used to improve inventory management practices, reduce costs, and increase profitability.

There are different types of inventory analytics, including:

- Descriptive analytics:This type of analytics provides a snapshot of current inventory levels and trends. It can be used to identify areas where inventory is overstocked or understocked.

- Predictive analytics:This type of analytics uses historical data to predict future inventory needs. It can be used to avoid stockouts and optimize inventory levels.

- Prescriptive analytics:This type of analytics provides recommendations for how to improve inventory management practices. It can be used to identify the most cost-effective inventory strategies.

The benefits of using inventory analytics include:

- Reduced costs:Inventory analytics can help businesses reduce costs by identifying areas where inventory is overstocked or understocked. This can lead to lower carrying costs, reduced waste, and improved cash flow.

- Increased profitability:Inventory analytics can help businesses increase profitability by optimizing inventory levels. This can lead to increased sales, reduced markdowns, and improved customer satisfaction.

- Improved customer service:Inventory analytics can help businesses improve customer service by ensuring that they have the right products in stock at the right time. This can lead to reduced backorders, faster delivery times, and happier customers.

End of Discussion: Business Inventory Strategy Abbr Crossword

Mastering business inventory strategy is a continuous journey that requires a comprehensive understanding of inventory management, optimization, analytics, and forecasting. By embracing the insights presented in this guide, businesses can unlock the full potential of their inventory, driving growth and success in today’s competitive market landscape.