Business inventory property tax, a critical aspect of local government revenue generation, plays a significant role in shaping the financial landscape for businesses. This comprehensive guide delves into the intricacies of business inventory property tax, providing a clear understanding of its purpose, assessment, and impact on businesses.

Understanding the nuances of business inventory property tax is essential for business owners to ensure compliance and minimize their tax liability. This guide provides valuable insights into the various aspects of the tax, empowering businesses to make informed decisions and navigate the complexities of property tax regulations.

Determining Taxable Inventory

Identifying the types of inventory subject to property tax and the criteria used to determine what constitutes taxable inventory is crucial for accurate tax assessment.

Types of Taxable Inventory

- Raw materials:Unprocessed or partially processed materials used in production.

- Work-in-process inventory:Goods in various stages of completion, not yet ready for sale.

- Finished goods:Completed products ready for sale.

- Maintenance, repair, and operating supplies (MRO):Items used to maintain and operate the business, such as tools, spare parts, and cleaning supplies.

Criteria for Determining Taxability

To determine whether inventory is taxable, the following criteria are generally considered:

- Ownership:Inventory owned by the business is taxable.

- Location:Inventory physically located within the taxing jurisdiction is taxable.

- Purpose:Inventory held for sale or use in the ordinary course of business is taxable.

- Consignment:Inventory held on consignment (i.e., not owned by the business) is generally not taxable.

- Exemptions:Certain types of inventory may be exempt from property tax, such as inventory used in manufacturing or agriculture.

Payment and Administration

The payment process for business inventory property tax involves submitting the required tax forms and making timely payments to the designated local government agency. The specific procedures may vary depending on the locality, but generally involve the following steps:

- Assessment:The local government assesses the value of the inventory and determines the amount of tax due.

- Tax Bill:The taxpayer receives a tax bill with the amount of tax due and the payment deadline.

- Payment Options:The taxpayer can choose to pay the tax in full or make installment payments.

- Payment Methods:The taxpayer can make payments online, by mail, or in person at the local government office.

- Payment Deadline:The tax bill specifies the payment deadline, and penalties may apply for late payments.

Role of Local Governments

Local governments play a crucial role in administering business inventory property tax. Their responsibilities include:

- Assessment:Determining the value of the inventory for taxation purposes.

- Tax Collection:Issuing tax bills and collecting payments.

- Enforcement:Ensuring compliance with tax laws and regulations.

- Appeals Process:Providing a process for taxpayers to challenge their assessments or tax bills.

- Tax Rate Setting:Establishing the property tax rate for business inventory.

Impact on Businesses: Business Inventory Property Tax

Business inventory property tax can have a significant impact on businesses, affecting their cash flow, profitability, and overall financial performance. Businesses must carefully consider the potential impact of this tax and develop strategies to minimize their tax liability.

One of the primary impacts of business inventory property tax is the potential for increased costs. Businesses are required to pay taxes on the value of their inventory, which can represent a substantial portion of their assets. This can lead to higher operating expenses and reduced profitability.

Strategies to Minimize Tax Liability, Business inventory property tax

Businesses can employ several strategies to minimize their business inventory property tax liability. These strategies include:

- Reducing inventory levels:By reducing the amount of inventory on hand, businesses can lower their tax liability. This can be achieved through improved inventory management practices, such as just-in-time inventory systems or vendor-managed inventory.

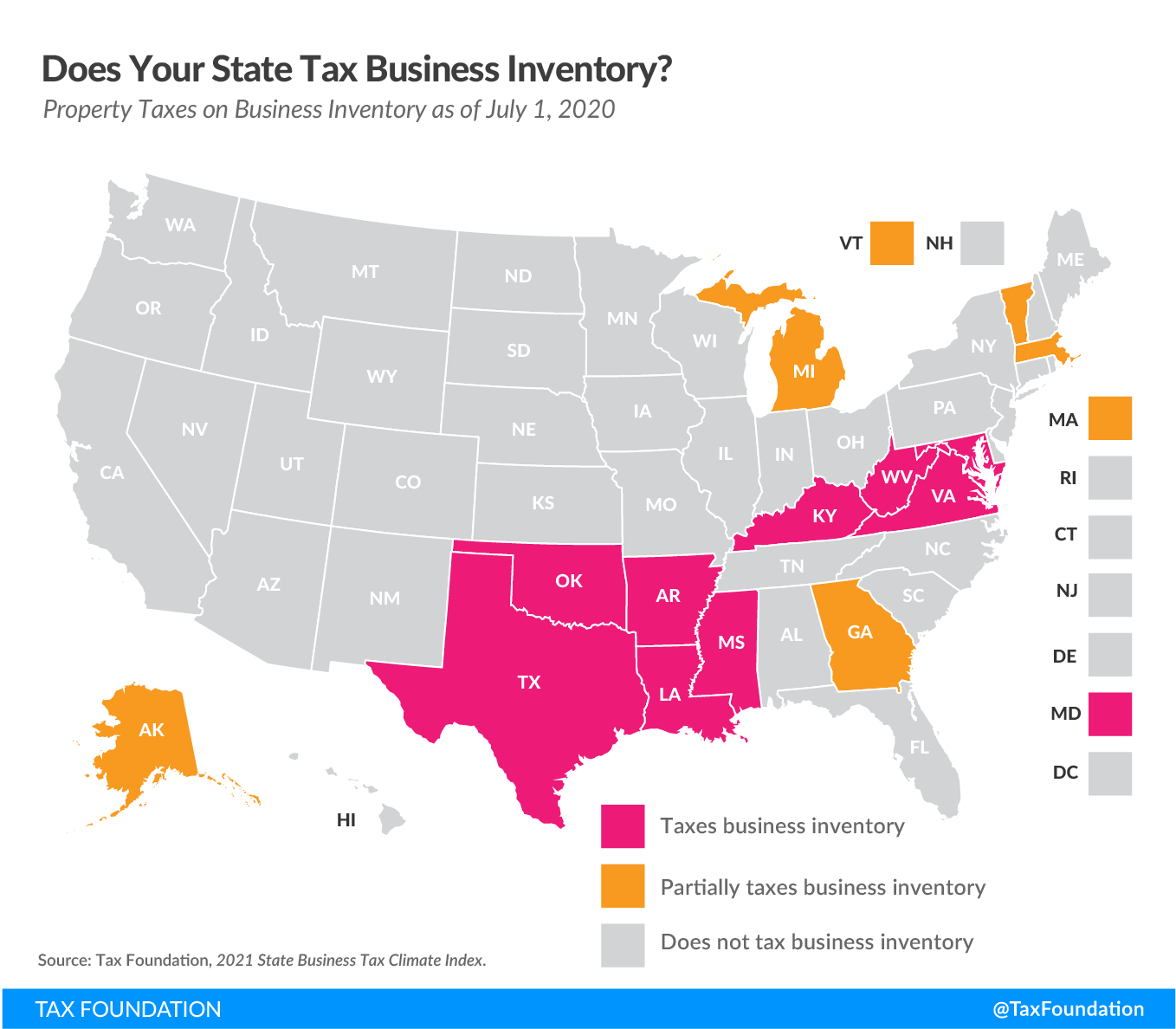

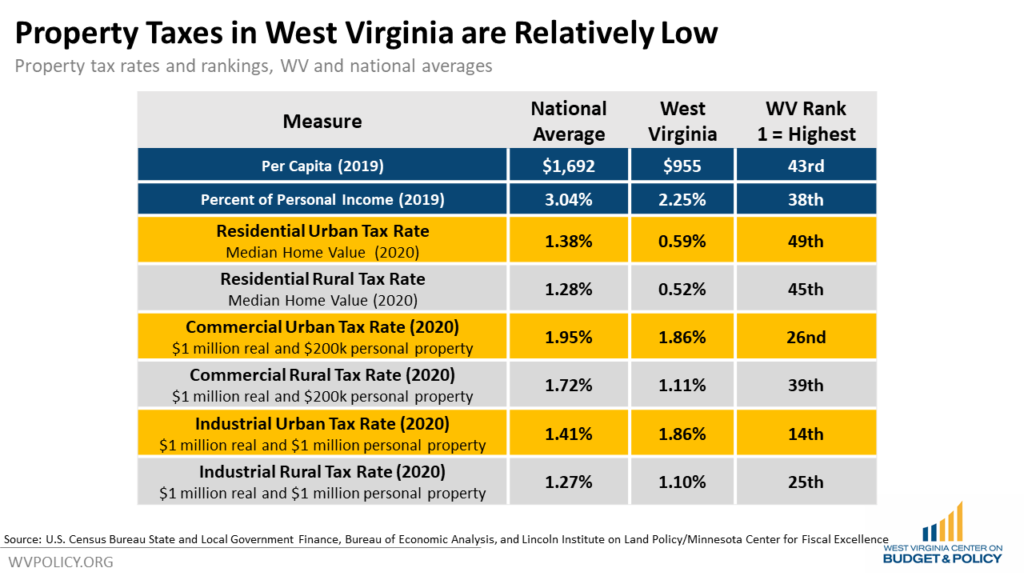

- Storing inventory in tax-advantaged locations:Some states offer tax exemptions or reduced rates for inventory stored in certain locations, such as foreign trade zones or enterprise zones. Businesses can explore these options to reduce their tax burden.

- Negotiating with tax assessors:Businesses can negotiate with tax assessors to reduce the assessed value of their inventory. This can be done by providing documentation to support the value of the inventory, such as purchase invoices or appraisals.

- Filing appeals:If a business believes that their inventory has been assessed at an incorrect value, they can file an appeal with the local tax authority. This process may involve presenting evidence to support the correct value of the inventory.

Closing Summary

In conclusion, business inventory property tax is a multifaceted aspect of local government finance that requires careful consideration by business owners. By understanding the intricacies of the tax, businesses can effectively manage their inventory and minimize their tax liability. This guide serves as a valuable resource for business owners seeking to navigate the complexities of business inventory property tax, ensuring compliance and optimizing their financial position.