The concept of business inventory fiscal year tax plays a pivotal role in the financial landscape of businesses. Effective inventory management is not only crucial for operational efficiency but also has significant implications for tax liability. This article delves into the intricacies of business inventory fiscal year tax, exploring the various inventory valuation methods, costing techniques, and their impact on tax calculations.

Understanding the relationship between inventory turnover and tax liability is essential for businesses seeking to optimize their tax savings. This article will shed light on the tax implications of inventory losses, including casualty losses and obsolete inventory, and the documentation requirements for claiming these losses.

Inventory and Income Taxes: Business Inventory Fiscal Year Tax

Inventory plays a significant role in determining taxable income and effective tax rates. The Internal Revenue Service (IRS) requires businesses to account for inventory using one of three methods: First-In, First-Out (FIFO), Last-In, First-Out (LIFO), or Weighted Average Cost (WAC).

The method chosen can have a substantial impact on the timing of income and expenses recognized for tax purposes.

Timing of Income and Expenses, Business inventory fiscal year tax

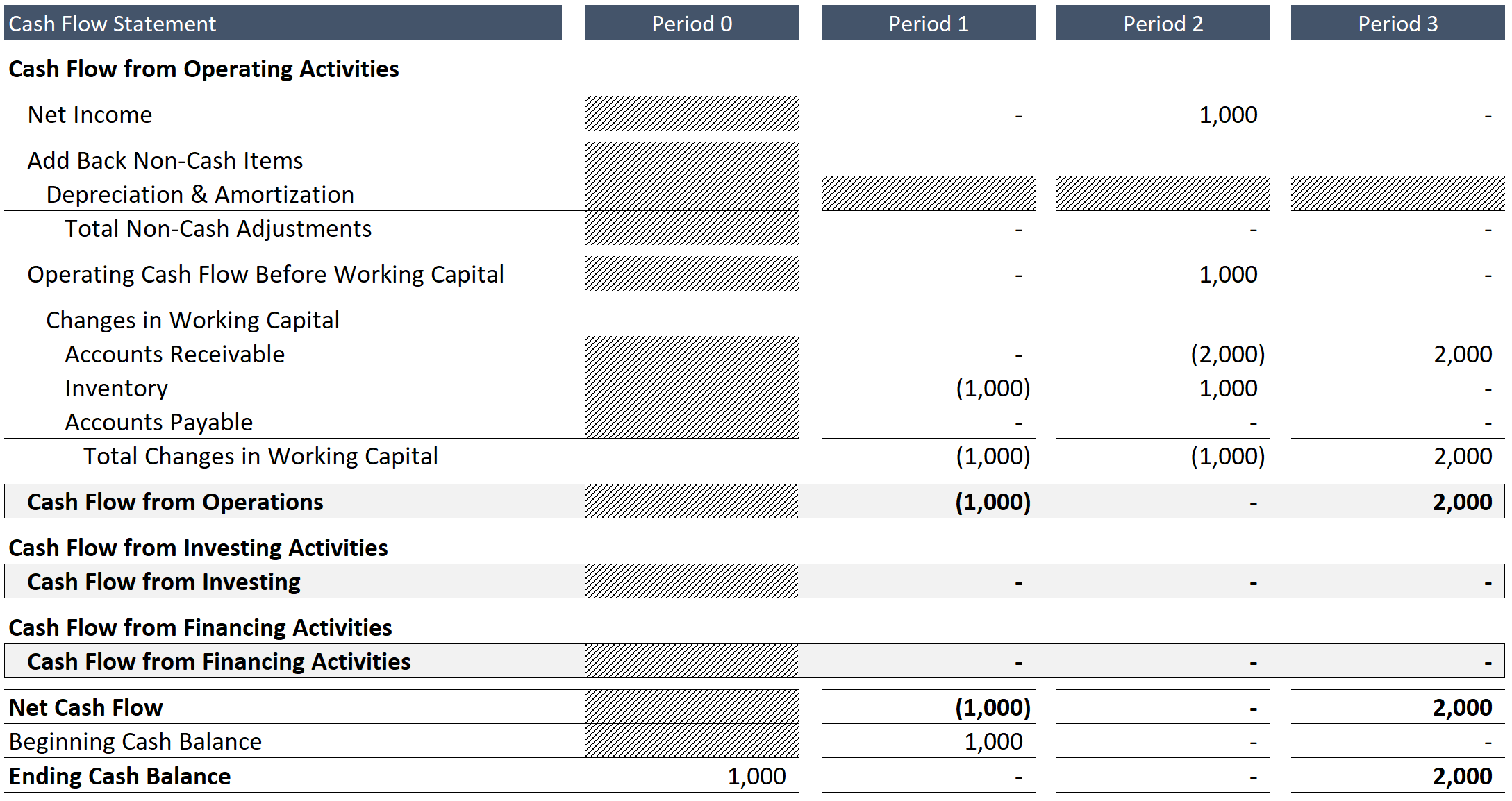

The timing of income and expenses related to inventory is crucial for tax purposes. When inventory is sold, the cost of goods sold (COGS) is deducted from revenue to determine the gross profit. The COGS is determined based on the inventory valuation method used by the business.

For example, under FIFO, the cost of the oldest inventory purchased is deducted first, while under LIFO, the cost of the most recently purchased inventory is deducted first.

Impact on Taxable Income and Effective Tax Rates

The inventory valuation method selected can significantly impact taxable income and effective tax rates. In periods of rising prices, FIFO tends to result in higher COGS and lower taxable income compared to LIFO. This is because FIFO assigns the lower historical costs to COGS, reducing the gross profit.

Conversely, in periods of falling prices, LIFO tends to result in higher COGS and lower taxable income compared to FIFO.The effective tax rate is calculated by dividing the total tax liability by the taxable income. A higher effective tax rate indicates that a greater proportion of taxable income is being paid in taxes.

The choice of inventory valuation method can influence the effective tax rate by affecting the amount of taxable income reported.

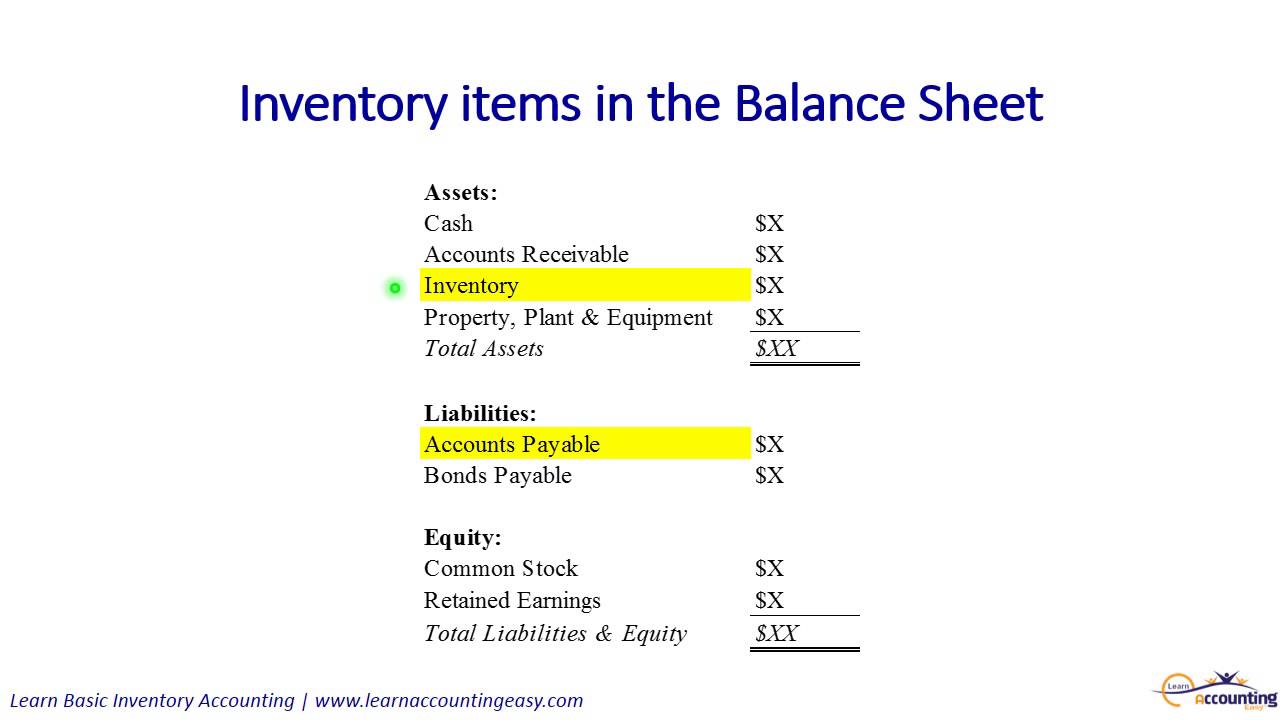

Inventory and Property Taxes

Inventory is typically considered personal property for property tax purposes. This means that it is subject to the same property tax rules and regulations that apply to other personal property, such as vehicles and equipment.

However, there are some specific property tax rules and regulations that apply to inventory. For example, in some states, inventory is exempt from property tax. In other states, inventory is taxed at a reduced rate. Additionally, some states have special rules for valuing inventory for property tax purposes.

Inventory Tax Exemptions

In some states, inventory is exempt from property tax. This is typically the case for states that have a business inventory tax exemption. A business inventory tax exemption is a law that exempts businesses from paying property tax on their inventory.

The purpose of a business inventory tax exemption is to encourage businesses to keep their inventory in the state.

- For example, California has a business inventory tax exemption. This exemption applies to all businesses that have inventory in California. The exemption is available for both raw materials and finished goods.

- Another example is Texas. Texas has a business inventory tax exemption for manufacturers. This exemption applies to all manufacturers that have inventory in Texas. The exemption is available for both raw materials and finished goods.

Last Point

In conclusion, business inventory fiscal year tax is a complex but manageable aspect of tax compliance. By gaining a comprehensive understanding of the various inventory valuation methods, costing techniques, and tax implications, businesses can effectively manage their inventory to minimize tax liability and maximize profitability.

This article provides a valuable resource for businesses seeking to navigate the complexities of inventory management and tax efficiency.