In the world of business, cash flow is king. And when it comes to managing inventory, cash can often get tied up, leaving businesses struggling to keep up with growth. Enter business inventory finance: the secret weapon for unlocking cash flow and fueling your entrepreneurial dreams.

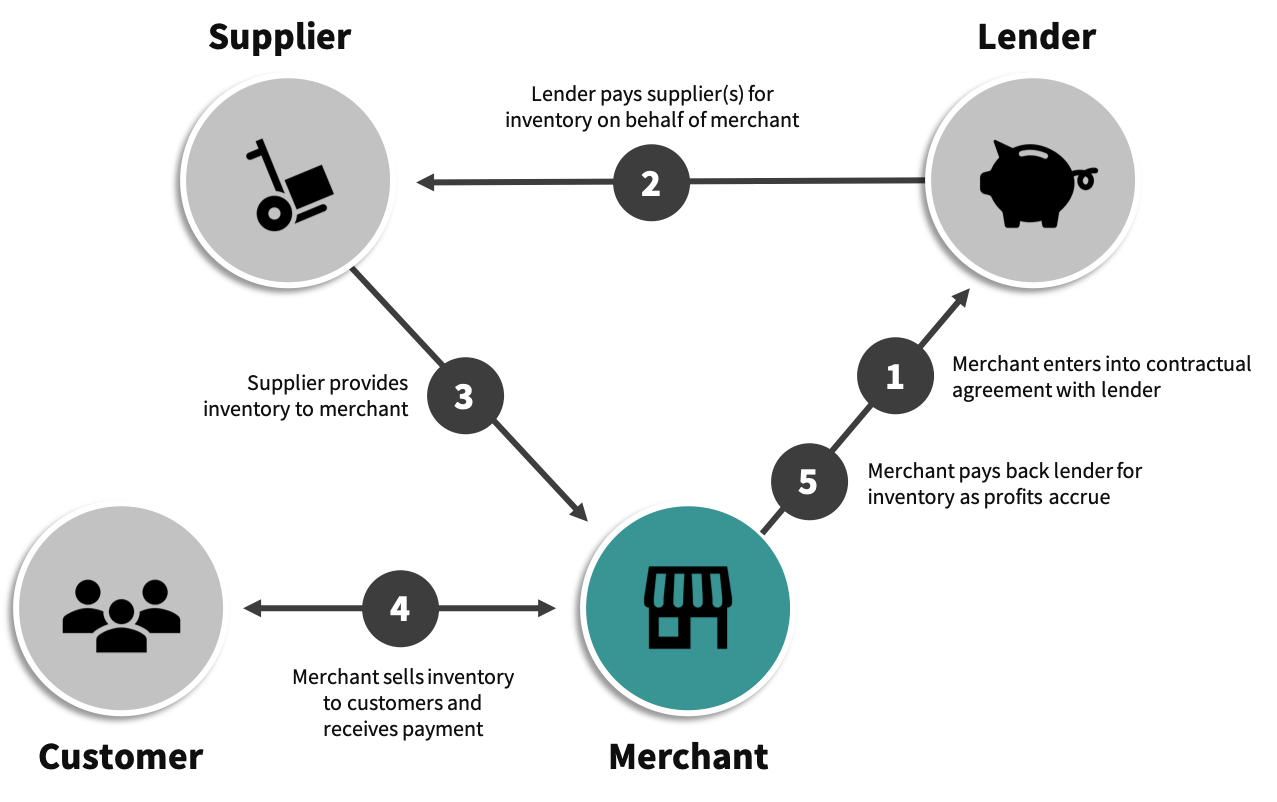

From manufacturers to retailers, businesses of all sizes rely on inventory to meet customer demand. But holding onto inventory can be a costly affair, especially when cash is tight. That’s where inventory finance steps in, providing a lifeline to businesses looking to bridge the gap between inventory purchases and sales.

Types of Business Inventory Finance

Inventory financing is a lifeline for businesses that need to maintain a steady supply of inventory without tying up too much cash. There are several types of inventory financing available, each with its own advantages and disadvantages. The best option for a particular business will depend on a number of factors, including the size of the business, the type of inventory, and the business’s financial situation.

Floor Planning

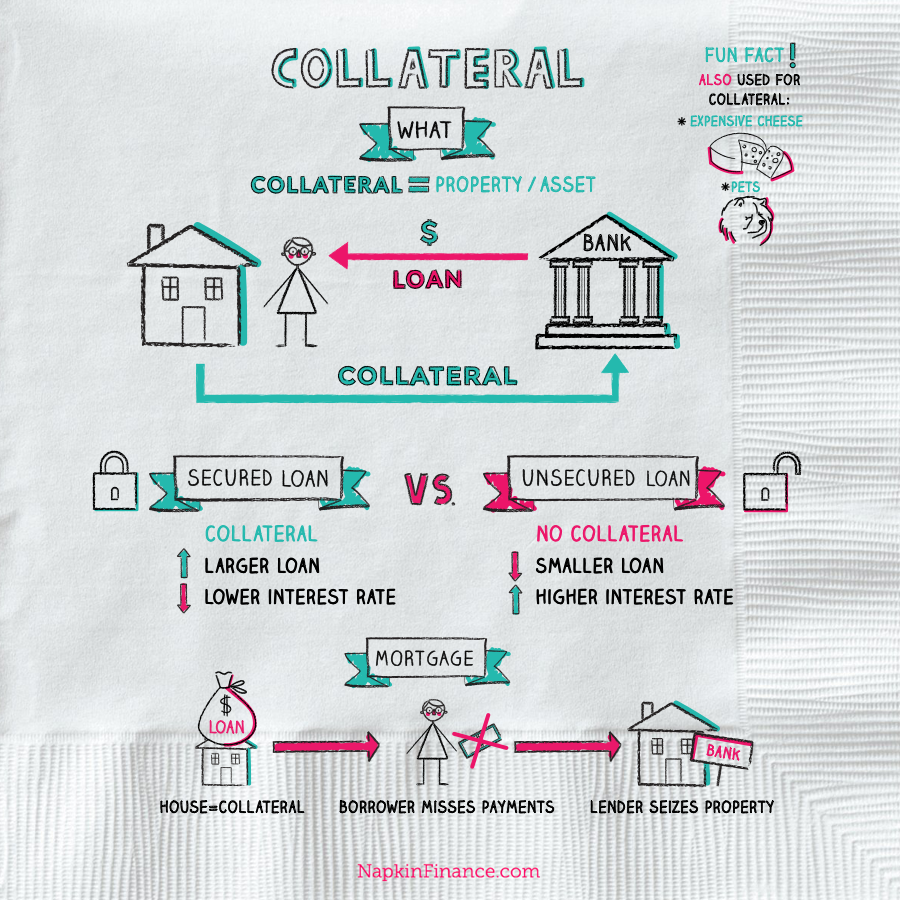

Floor planning is a type of inventory financing in which the lender provides the business with a line of credit that can be used to purchase inventory. The inventory is then used as collateral for the loan. Floor planning is a good option for businesses that need to maintain a high level of inventory, such as car dealerships or furniture stores.

Advantages:

- Floor planning provides businesses with a flexible source of financing that can be used to purchase inventory as needed.

- The interest rates on floor planning loans are typically lower than the interest rates on other types of business loans.

Disadvantages:

- Floor planning can be expensive, as the lender will typically charge a fee for each transaction.

- The lender may require the business to maintain a certain level of inventory, which can tie up the business’s cash flow.

Inventory Factoring

Inventory factoring is a type of inventory financing in which the lender purchases the business’s accounts receivable at a discount. The lender then collects the payments from the business’s customers and remits the proceeds to the business, minus the discount.

Inventory factoring is a good option for businesses that have a high volume of sales but need to improve their cash flow.

Advantages:

- Inventory factoring provides businesses with a quick and easy way to improve their cash flow.

- The lender will typically advance the business up to 80% of the value of the accounts receivable.

Disadvantages:

- Inventory factoring can be expensive, as the lender will typically charge a fee for each transaction.

- The lender may require the business to provide personal guarantees for the loan.

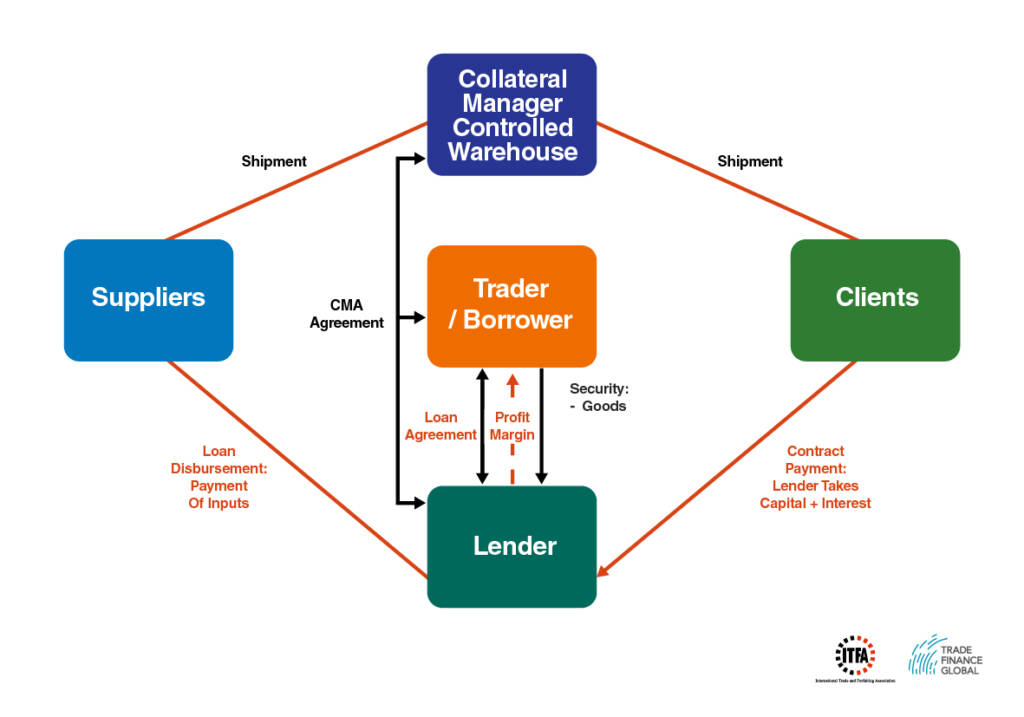

Warehouse Receipt Financing

Warehouse receipt financing is a type of inventory financing in which the lender provides the business with a loan secured by the business’s inventory. The inventory is stored in a warehouse, and the lender holds the warehouse receipt as collateral for the loan.

Warehouse receipt financing is a good option for businesses that need to store their inventory in a secure location.

Advantages:

- Warehouse receipt financing provides businesses with a flexible source of financing that can be used to purchase inventory or to cover other business expenses.

- The interest rates on warehouse receipt loans are typically lower than the interest rates on other types of business loans.

Disadvantages:

- Warehouse receipt financing can be expensive, as the lender will typically charge a fee for each transaction.

- The lender may require the business to maintain a certain level of inventory, which can tie up the business’s cash flow.

Factors to Consider When Choosing an Inventory Financing Option

When choosing an inventory financing option, businesses should consider the following factors:

- The size of the business

- The type of inventory

- The business’s financial situation

- The cost of the financing

- The flexibility of the financing

- The lender’s reputation

Considerations for Business Inventory Finance

Before taking the plunge into the world of inventory finance, it’s like a road trip – you need a map, some snacks, and a plan to avoid getting lost. So, buckle up and let’s explore the key considerations that will help you navigate the inventory finance landscape like a seasoned pro.

Assessing Business Needs and Financial Health

Start by taking a good look in the mirror – what’s your business’s financial health like? Are you a fitness buff or in need of a financial makeover? Inventory finance can be a turbo boost for your business, but it’s crucial to make sure you’re financially fit enough to handle it.

Inventory Turnover Rates and Management Practices

Inventory turnover rates are like the heartbeat of your inventory – they show how efficiently you’re moving products off the shelves and into customers’ hands. High turnover rates mean you’re a master of inventory management, while low rates could indicate a sluggish flow that’s costing you money.

Your inventory management practices are like the secret sauce that keeps your inventory humming. Are you using technology to track and optimize your stock levels, or is it still a pen-and-paper affair? Streamlined practices can make a world of difference in reducing costs and boosting efficiency.

Alternative Financing Options

Introduction

When traditional inventory financing options don’t quite cut it, businesses can turn to alternative financing options. These options offer flexibility, speed, and accessibility, making them attractive to businesses of all sizes. Let’s dive into the world of alternative inventory financing and explore the pros and cons of each option.

Types of Alternative Financing Options, Business inventory finance

- Invoice Factoring:Sell your unpaid invoices to a factoring company for immediate cash. Pros:Quick access to funds, no personal guarantees required. Cons:Can be expensive, may damage customer relationships.

- Purchase Order Financing:Get financing based on purchase orders from creditworthy customers. Pros:Helps cover the cost of inventory upfront, no personal guarantees required. Cons:Limited to businesses with strong customer relationships.

- Asset-Based Lending:Use inventory and other assets as collateral for a loan. Pros:Higher loan amounts, lower interest rates than other alternatives. Cons:Requires significant collateral, can be time-consuming to secure.

- Crowdfunding:Raise funds from a large number of investors through online platforms. Pros:Potential for large amounts of funding, can build brand awareness. Cons:Can be competitive, requires a strong marketing campaign.

- Supplier Financing:Negotiate extended payment terms or discounts with suppliers. Pros:Can reduce the cost of inventory, improves cash flow. Cons:May require strong supplier relationships, can limit inventory options.

Who Benefits from Alternative Financing?

Alternative financing options are particularly beneficial for businesses that:

- Need quick access to funds to cover inventory costs

- Have limited access to traditional financing options

- Want to avoid personal guarantees

- Are looking for flexible and customizable financing solutions

Ending Remarks

So, whether you’re a seasoned pro or just starting out, consider business inventory finance as your secret weapon for growth. It’s the key to unlocking cash flow, boosting profitability, and taking your business to the next level. Embrace the power of inventory finance and watch your business soar!

FAQ Insights

What’s the catch with business inventory finance?

No catch, just a helping hand! Inventory finance is designed to support businesses, not hinder them. It’s a flexible solution that adapts to your needs and helps you grow.

How do I know if my business qualifies for inventory finance?

Lenders typically look at your business’s financial health, inventory turnover rates, and management practices. If you’re in good standing, you’ve got a good chance of approval.

What are some alternative financing options for inventory?

Crowdfunding, invoice factoring, and asset-based lending are all viable alternatives to traditional inventory financing. Explore your options and find the one that fits your business best.