Business inventories meaning, you ask? Well, my friend, it’s like the secret stash of goods that businesses keep hidden away, waiting for the perfect moment to unleash them upon the world. From the raw materials that fuel production to the finished products that make us go “oooh” and “ahhh,” inventories are the lifeblood of any successful business.

So, let’s dive into this inventory wonderland and uncover the secrets of keeping stock like a pro. Hold on tight, because this journey is about to get as exciting as a game of hide-and-seek with a mischievous toddler.

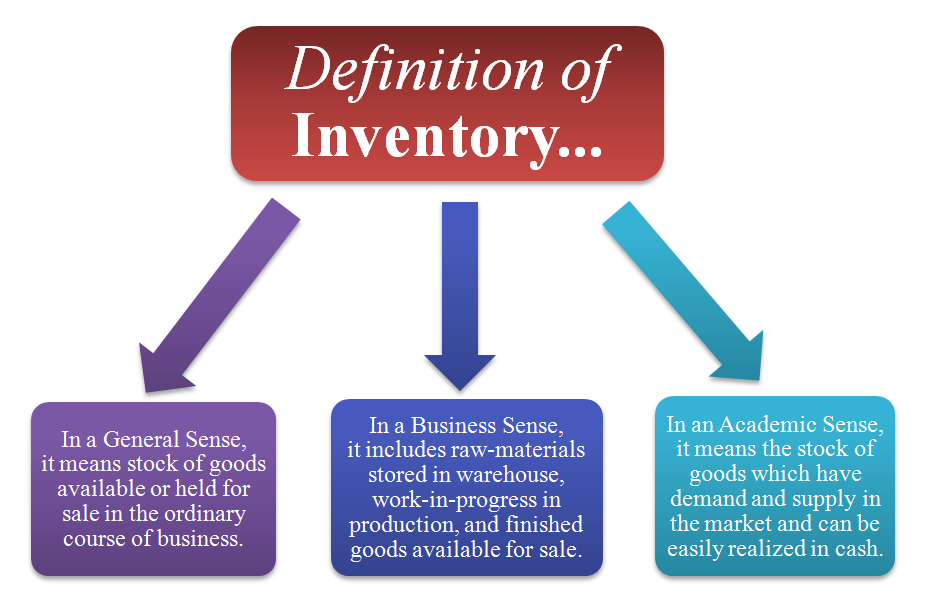

Definition of Business Inventories: Business Inventories Meaning

In the business world, inventories are like the lifeline that keeps operations flowing. They represent the stock of goods and materials that businesses have on hand, ready to be sold or used in production. Think of them as the pantry of a restaurant, filled with ingredients and supplies needed to create delicious meals for hungry customers.

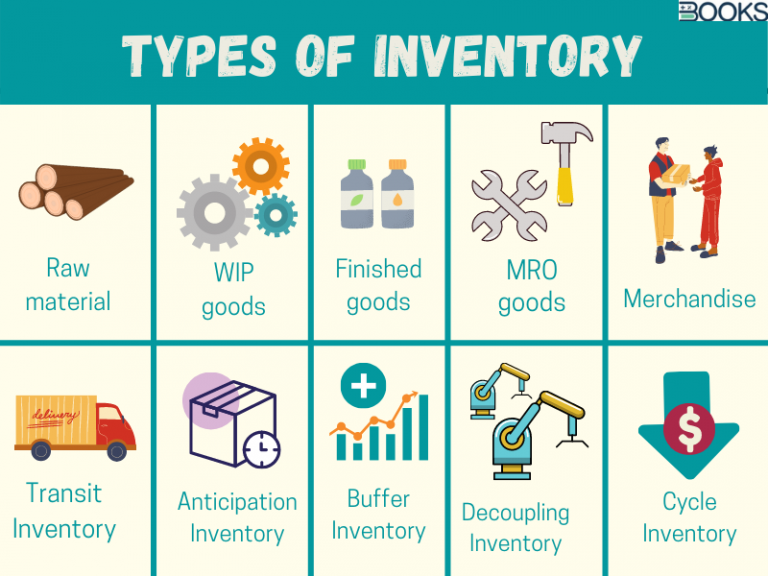

There are different types of inventories, each playing a specific role in the business process. Raw materials are the building blocks of products, waiting to be transformed into something amazing. Work-in-progress inventories are those partially completed products, like a half-baked cake that still needs some time in the oven.

And finally, finished goods inventories are the completed products, ready to hit the shelves and make their way into the hands of eager customers.

Inventory management is like a delicate dance, a balancing act that businesses must master to keep their operations running smoothly. Too little inventory can lead to stockouts and disappointed customers, while too much inventory can tie up valuable resources and eat into profits.

It’s all about finding that sweet spot, ensuring that businesses have just the right amount of inventory to meet customer demand without overstocking or running out.

Components of Business Inventories

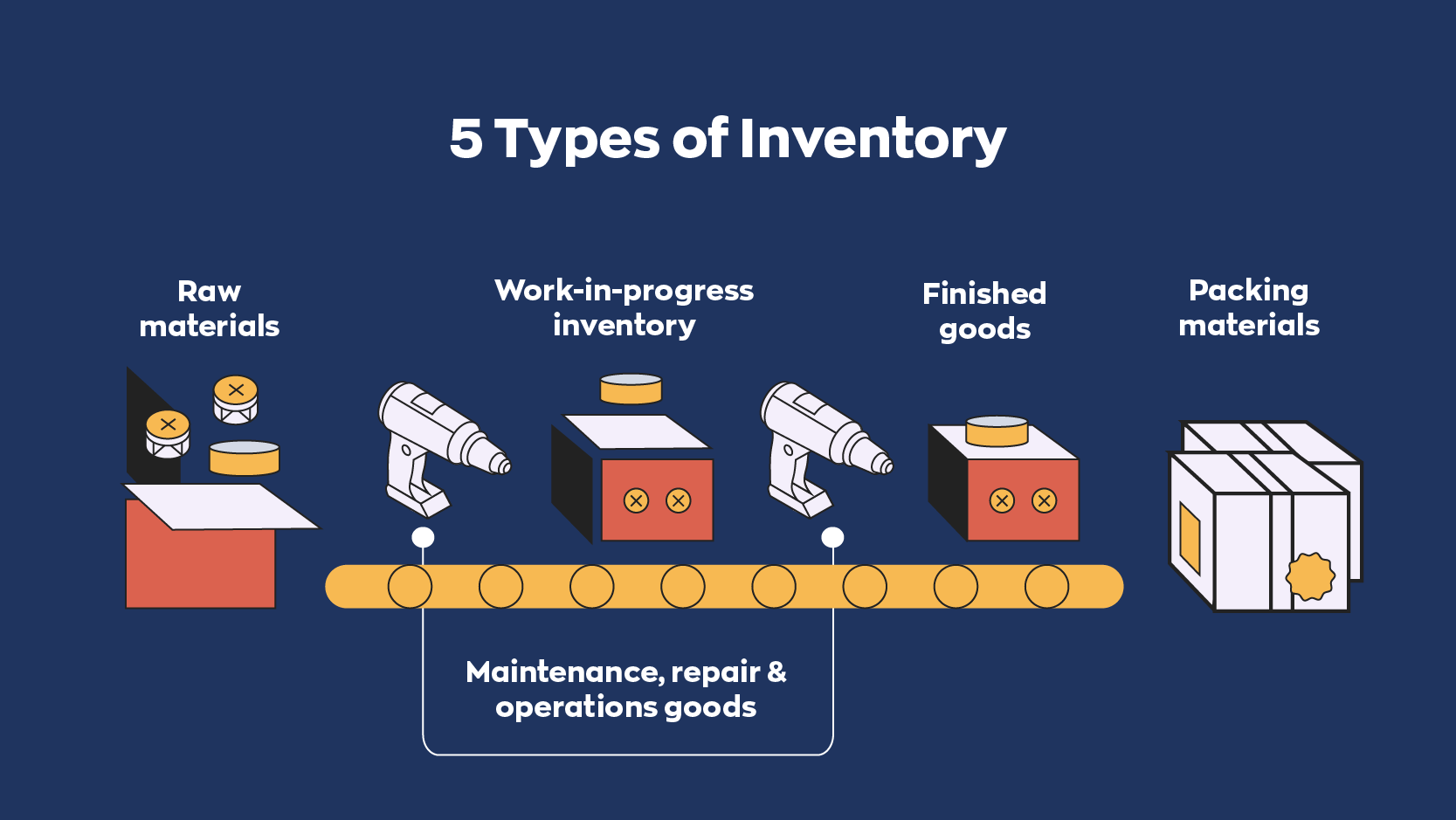

Business inventories are like a treasure chest filled with goodies for a company. They’re the raw materials, work-in-progress, and finished products that keep the business running smoothly. Let’s dive into each component and see how they play their part in the inventory system.

Raw Materials

Raw materials are the building blocks of any product. They’re the unprocessed goods that are transformed into something valuable. Think of them as the flour, sugar, and chocolate chips that go into making a delicious cookie.

Work-in-Progress

Work-in-progress (WIP) is the stuff that’s still being worked on. It’s the halfway point between raw materials and finished goods. WIP can be anything from a partially assembled car to a half-written novel.

Finished Goods, Business inventories meaning

Finished goods are the final products, ready to be sold to eager customers. They’re the polished cars, the printed novels, and the freshly baked cookies that bring in the revenue for the business.

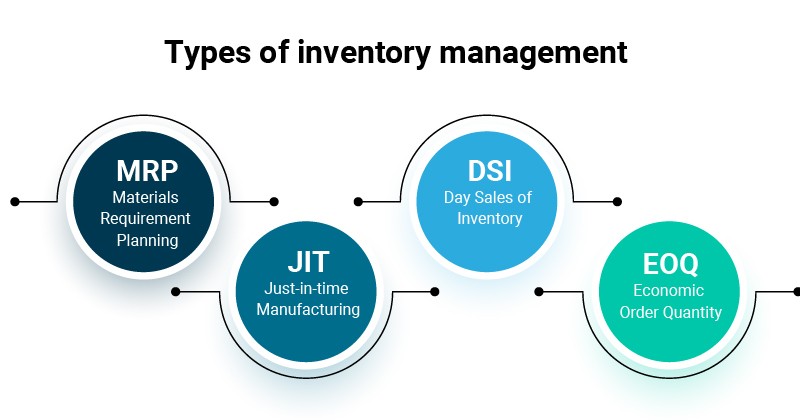

Inventory Management Techniques

Inventory management techniques are strategies and methods used by businesses to optimize their inventory levels and ensure the smooth flow of goods. Effective inventory management helps businesses minimize costs, improve customer service, and maximize profitability.

There are various inventory management techniques, each with its own advantages and disadvantages. The choice of technique depends on factors such as the nature of the business, the type of inventory, and the desired level of inventory accuracy.

First-In, First-Out (FIFO)

FIFO is an inventory management technique that assumes that the first items purchased are the first items sold. This means that the cost of goods sold is based on the cost of the oldest inventory on hand.

FIFO has the advantage of providing a more accurate representation of the current cost of goods sold, as it reflects the most recent purchases. However, it can also lead to higher inventory carrying costs, as older inventory may be held for longer periods.

Last-In, First-Out (LIFO)

LIFO is an inventory management technique that assumes that the last items purchased are the first items sold. This means that the cost of goods sold is based on the cost of the most recent inventory on hand.

LIFO has the advantage of reducing inventory carrying costs, as older inventory is sold first. However, it can also lead to a less accurate representation of the current cost of goods sold, as it does not reflect the most recent purchases.

Weighted Average Cost

Weighted average cost is an inventory management technique that calculates the cost of goods sold based on the average cost of all inventory on hand. This is done by dividing the total cost of inventory by the total number of units on hand.

Weighted average cost has the advantage of providing a more stable cost of goods sold, as it is not affected by the order in which inventory is purchased or sold. However, it can also be more complex to calculate than FIFO or LIFO.

Impact of Business Inventories on Financial Statements

Business inventories play a pivotal role in the financial health of a company. They directly impact the balance sheet and income statement, influencing profitability, liquidity, and overall financial performance.

On the balance sheet, inventories are classified as current assets. They represent the value of goods held for sale or used in the production process. High inventory levels can tie up a significant amount of cash, reducing a company’s liquidity.

Conversely, low inventory levels may result in stockouts, leading to lost sales and dissatisfied customers.

Effect on Profitability

Inventory levels can significantly impact a company’s profitability. Excessive inventory can lead to obsolescence, spoilage, and increased storage costs, eating into profit margins. On the other hand, insufficient inventory can result in lost sales and potential penalties for failing to fulfill customer orders.

Effect on Liquidity

High inventory levels can strain a company’s liquidity, as cash is tied up in unsold goods. This can make it challenging to meet short-term obligations, such as paying suppliers or covering operating expenses. Conversely, low inventory levels can improve liquidity by freeing up cash for other uses.

Financial Statement Analysis

Financial statement analysis can provide valuable insights into the impact of inventories on a company’s financial health. Common ratios used to assess inventory management include:

- Inventory Turnover Ratio:Measures the number of times inventory is sold and replaced during a period.

- Days Sales in Inventory:Indicates the average number of days it takes to sell the entire inventory.

- Gross Profit Margin:Shows the percentage of sales revenue that exceeds the cost of goods sold, including inventory.

By analyzing these ratios, investors and analysts can gain a better understanding of a company’s inventory management practices and their impact on profitability and liquidity.

Wrap-Up

And there you have it, folks! Business inventories meaning, decoded and demystified. Remember, inventory management is not just about counting beans; it’s about mastering the art of balancing supply and demand, keeping your cash flow healthy, and making your customers dance with joy.

So, go forth and conquer the inventory kingdom, one spreadsheet at a time!

FAQ Summary

What’s the deal with FIFO, LIFO, and weighted average cost?

They’re like the three amigos of inventory valuation, each with its own quirks and advantages. FIFO (First In, First Out) assumes you sell the oldest items first, LIFO (Last In, First Out) thinks the newest items get sold first, and weighted average cost blends them all together like a delicious inventory smoothie.

Why should I care about inventory levels?

Because they’re like the canary in the coal mine for your business. Too much inventory, and you’re drowning in unsold goods. Too little, and you’re leaving money on the table. It’s all about finding the sweet spot, my friend.

Can I get a crash course in inventory management?

Absolutely! Just think of it as the ultimate balancing act. You want to keep enough stock to meet demand without turning your warehouse into a storage unit for forgotten dreams. And don’t forget to track your inventory like a hawk, because knowing what you have and where it is is half the battle.