Business inventory taxes on property taxes louisiana 2017 – In the realm of taxation, business inventory taxes on property taxes in Louisiana for the year 2017 present a multifaceted landscape. This article delves into the intricacies of these taxes, exploring their assessment, implications, and impact on business operations within the state.

Louisiana’s unique tax laws and regulations governing business inventory taxes warrant careful examination. This article provides a comprehensive overview of the relevant statutes and their implications, ensuring a thorough understanding of the tax obligations for businesses operating in Louisiana.

Property Tax Implications on Business Inventory

In Louisiana, business inventory is classified as personal property, and therefore, is subject to property taxes. This means that businesses must pay taxes on the value of their inventory, just as they would for any other type of personal property, such as equipment or furniture.

Inventory Classification and Tax Liability, Business inventory taxes on property taxes louisiana 2017

The classification of inventory as personal property has a significant impact on a business’s property tax liability. Personal property taxes are typically assessed at a higher rate than real property taxes, which means that businesses with large amounts of inventory may face substantial tax bills.

In addition, businesses are required to file an annual personal property tax return with the Louisiana Department of Revenue. This return must include a detailed list of all personal property owned by the business, including inventory. Failure to file a return or to accurately report the value of inventory can result in penalties and interest charges.

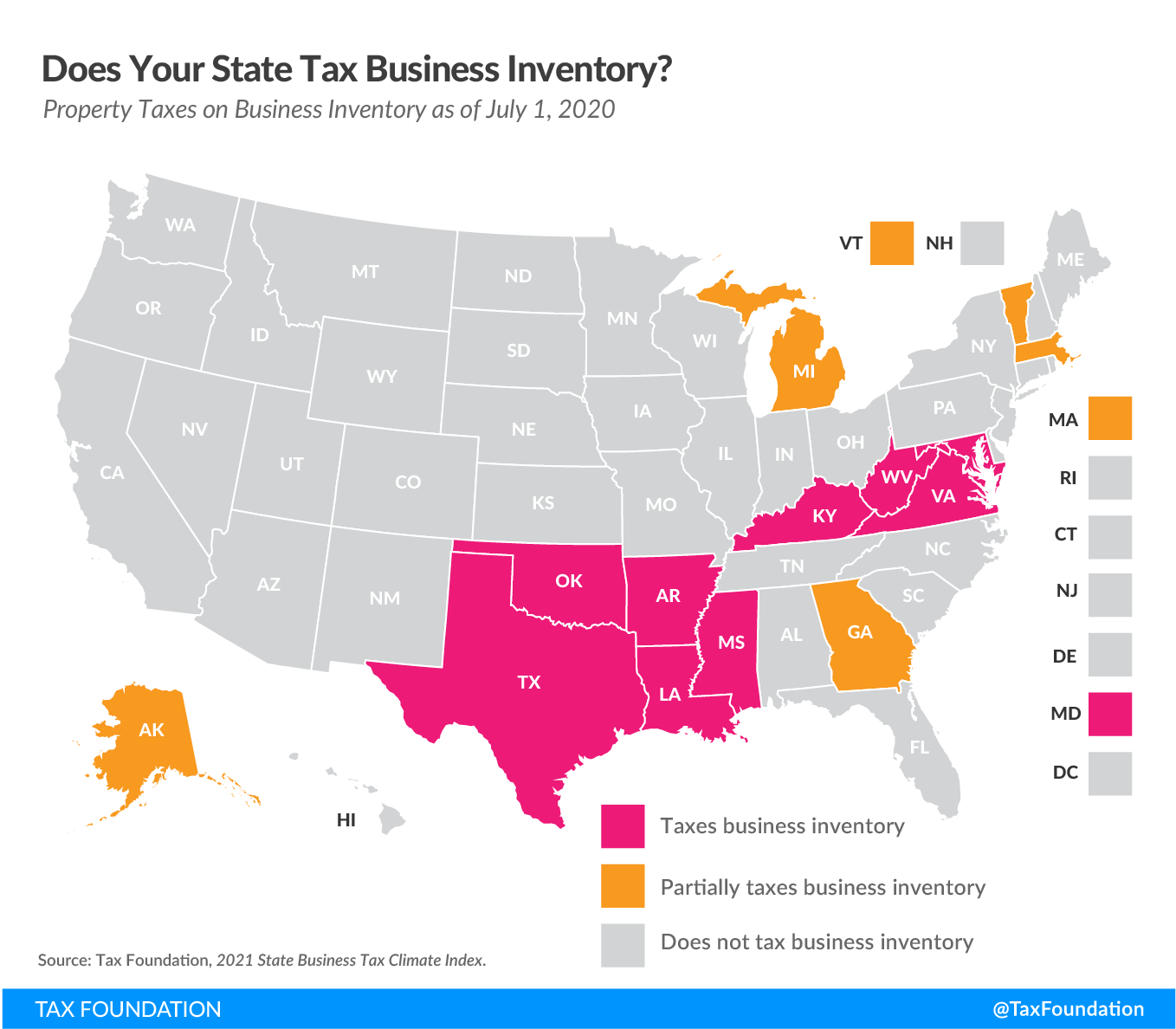

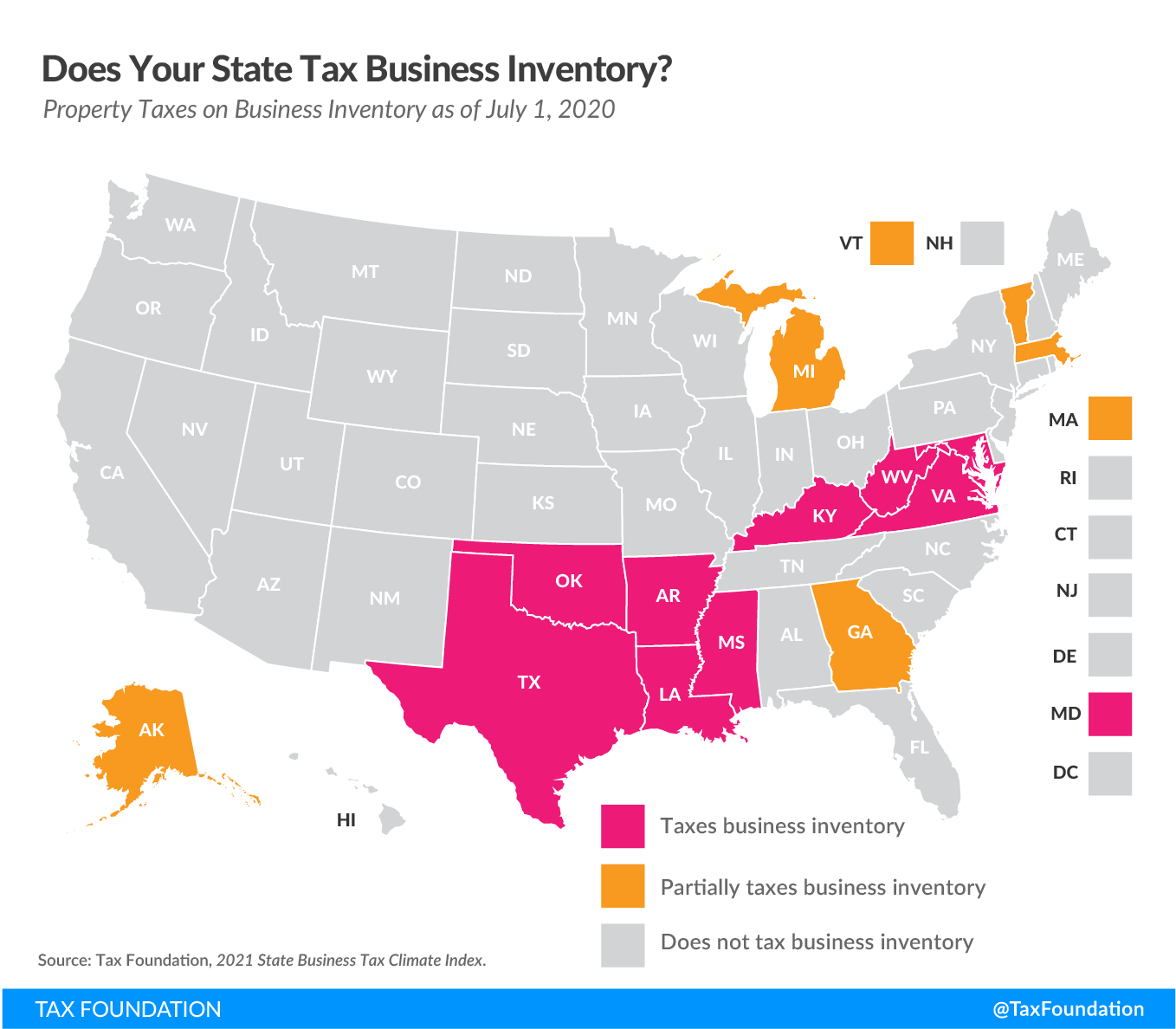

Comparison to Other States

Louisiana’s business inventory tax laws and regulations are generally comparable to those of neighboring states. However, there are some key similarities and differences that may impact businesses operating in multiple jurisdictions.

One similarity is that most states, including Louisiana, impose a sales and use tax on the sale or use of tangible personal property. However, the rates and exemptions vary from state to state. For example, Louisiana’s sales and use tax rate is 4.45%, while the rate in neighboring Mississippi is 7%.

Another similarity is that most states, including Louisiana, allow businesses to deduct the value of their inventory from their taxable income. However, the methods for calculating the inventory deduction vary from state to state. For example, Louisiana allows businesses to use the cost or market value method, while Mississippi allows businesses to use the lower of cost or market value method.

One key difference is that Louisiana does not have a specific business inventory tax. However, businesses are required to pay property taxes on their inventory. The property tax rate varies from parish to parish. In contrast, some neighboring states, such as Mississippi, have a specific business inventory tax in addition to property taxes.

Tax Implications for Businesses Operating in Multiple Jurisdictions

Businesses that operate in multiple jurisdictions need to be aware of the different business inventory tax laws and regulations in each jurisdiction. This is because the tax implications of holding inventory in different states can vary significantly.

For example, a business that holds inventory in Louisiana and Mississippi will need to pay sales and use tax on the inventory in both states. However, the business may be able to deduct the value of the inventory from its taxable income in both states.

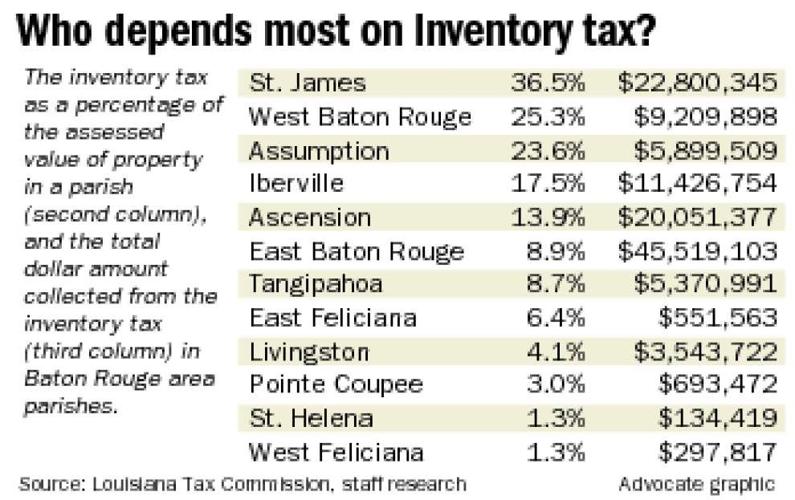

Additionally, the business will need to pay property taxes on the inventory in both states. However, the property tax rate may vary from parish to parish in Louisiana.

Businesses that are considering expanding into new jurisdictions should carefully consider the business inventory tax implications. This is because the tax implications can impact the profitability of the business.

Case Studies or Examples

Louisiana’s business inventory tax has had significant impacts on businesses operating within the state. Here are a few case studies that illustrate the practical implications and challenges associated with these taxes:

Impact on Small Businesses

Small businesses in Louisiana often struggle to cope with the financial burden imposed by business inventory taxes. For instance, a small retail store with an inventory value of $100,000 could face an annual tax bill of approximately $1,000. This can be a substantial expense for small businesses with limited profit margins.

Impact on Large Businesses

Large businesses with extensive inventory holdings are also affected by Louisiana’s business inventory tax. A manufacturing company with an inventory value of $1 million could face an annual tax bill of approximately $10,000. This can impact the company’s profitability and competitiveness in the market.

Impact on Warehousing and Distribution

The business inventory tax also affects warehousing and distribution operations in Louisiana. Businesses that store inventory in the state may face higher costs due to the tax. This can lead to increased warehousing costs and reduced efficiency in the supply chain.

Closure: Business Inventory Taxes On Property Taxes Louisiana 2017

Navigating the complexities of business inventory taxes on property taxes in Louisiana requires a comprehensive approach. By understanding the assessment process, property tax implications, and relevant regulations, businesses can effectively manage their tax liabilities and ensure compliance. This article serves as a valuable resource for taxpayers seeking to optimize their tax strategies and maintain a competitive edge in the Louisiana business landscape.