Business inventory tax rate hall county ga – Understanding the business inventory tax rate in Hall County, GA, is crucial for businesses operating within its jurisdiction. This guide delves into the intricacies of the tax rate, its impact on local businesses, and strategies for optimizing tax liability.

The business inventory tax rate in Hall County, GA, is determined by various factors and can have a significant impact on business operations. By analyzing historical trends and comparing the tax rate to neighboring counties, businesses can gain insights into potential future changes and make informed decisions.

Business Inventory Tax Rate in Hall County, GA

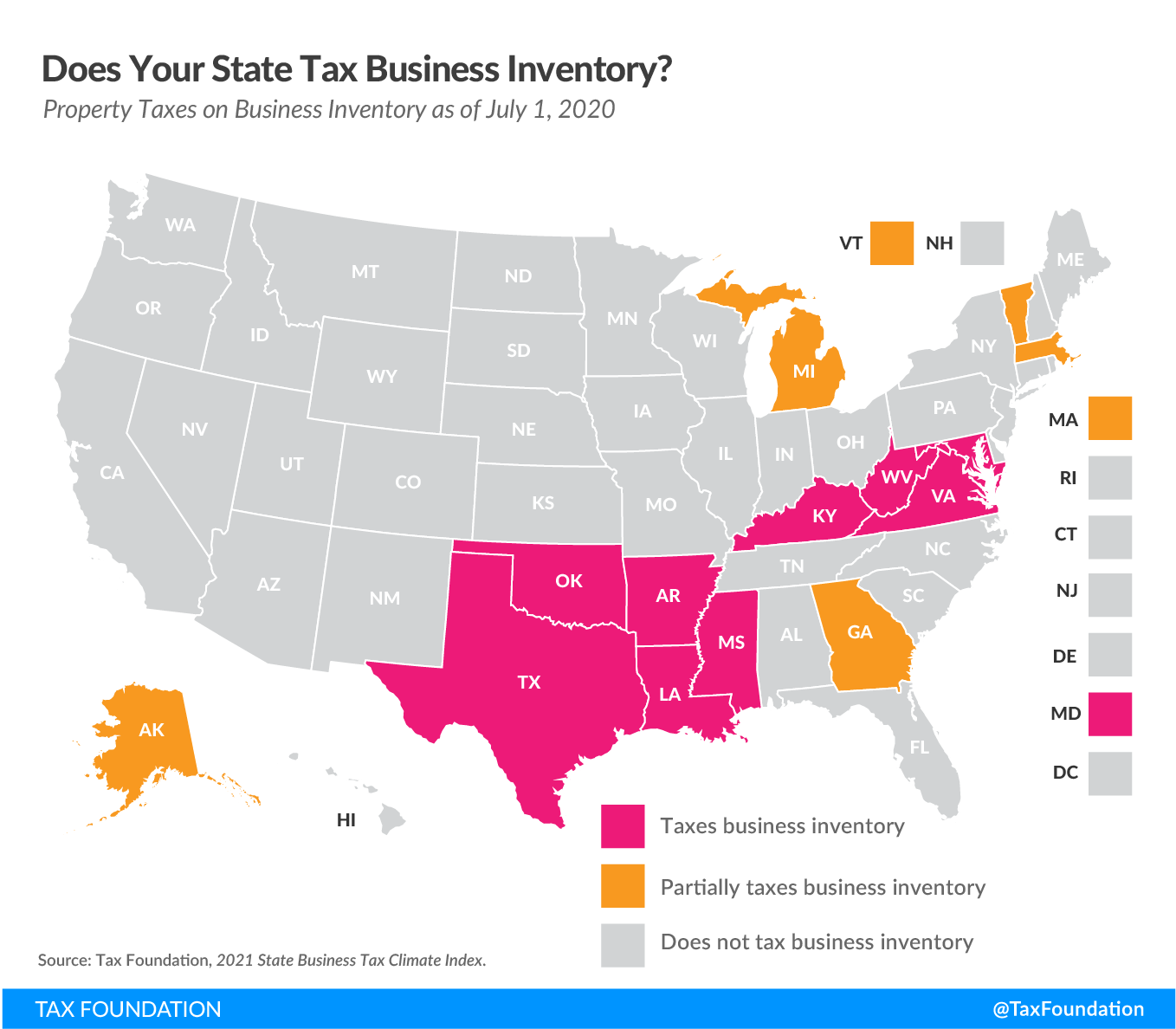

Hall County, Georgia, imposes a business inventory tax on the average value of inventory held for sale or lease in the county during the tax year. The tax rate is 0.04%, which is applied to the average monthly inventory value.Exemptions from the business inventory tax include:

- Inventory held by manufacturers for incorporation into a manufactured product;

- Inventory held by wholesalers for resale;

- Inventory held by retailers for resale;

- Inventory held by public utilities;

- Inventory held by non-profit organizations.

Comparison to Neighboring Counties

The business inventory tax rate in Hall County, GA, is 0.1%, which is comparable to the rates in neighboring counties.

For example, the business inventory tax rate in Gwinnett County is also 0.1%, while the rate in Forsyth County is 0.125%. This similarity in tax rates suggests that businesses in Hall County are not at a significant disadvantage compared to their counterparts in neighboring counties.

Barrow County

However, it is worth noting that Barrow County has a lower business inventory tax rate of 0.075%. This difference could potentially make Barrow County a more attractive location for businesses that hold large amounts of inventory.

Jackson County

On the other hand, Jackson County has a higher business inventory tax rate of 0.15%. This higher rate could discourage businesses from locating in Jackson County, particularly those that rely heavily on inventory.

Overall, the business inventory tax rate in Hall County, GA, is competitive with neighboring counties. However, businesses should be aware of the slightly lower rate in Barrow County and the slightly higher rate in Jackson County when making location decisions.

Strategies for Tax Optimization: Business Inventory Tax Rate Hall County Ga

Businesses can implement various strategies to optimize their business inventory tax liability in Hall County, GA. These strategies focus on reducing inventory levels, managing inventory turnover, and utilizing tax incentives.

Inventory levels can be reduced through efficient inventory management practices, such as implementing just-in-time (JIT) inventory systems, which reduce the amount of inventory held on hand.

Managing Inventory Turnover, Business inventory tax rate hall county ga

Managing inventory turnover involves optimizing the rate at which inventory is sold and replaced. A higher inventory turnover ratio indicates that inventory is being sold quickly and efficiently, resulting in lower tax liability. Businesses can improve inventory turnover by:

- Increasing sales through marketing and promotions.

- Reducing lead times and improving supply chain efficiency.

- Offering discounts for bulk purchases or early payments.

Utilizing Tax Incentives

Businesses may also utilize tax incentives offered by Hall County or the state of Georgia to reduce their inventory tax liability. These incentives may include:

- Exemptions for certain types of inventory, such as raw materials or work-in-progress.

- Reduced tax rates for businesses located in designated enterprise zones.

- Tax credits for businesses that invest in energy-efficient equipment or renewable energy projects.

Final Thoughts

In conclusion, the business inventory tax rate in Hall County, GA, is a complex issue with implications for local businesses. By understanding the tax rate, its impact, and strategies for optimization, businesses can effectively manage their inventory tax liability and enhance their financial performance.